Identity theft can occur in any number of ways such as responding to a phishing email about a fake charity – or a threatening phone call about your car’s extended warranty (sound familiar?) …. now we can add text messages to the list. We see these schemes all the time but they seem to ramp up during tax season.

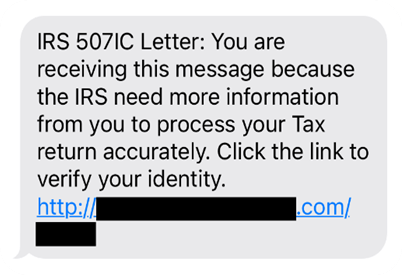

One of our team members recently received the text message shown below (we have redacted most of the link contained in the message). It seems like we can never remind ourselves often enough, “don’t click the link”. Maybe there’s something about human nature that compels us to click on blue underlined font.

Always remember if you ever see a text message or email claiming to be from the IRS:

The IRS does not initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. Don’t click the link.

Following are a couple scenarios to consider. One may apply to you more than the other depending on how you prefer to send information to your financial advisor or tax preparer.

Scenario #1:

Earlier in the week you emailed your tax preparer with a handful of tax documents attached. You don’t hear from them for a few days. Then, the text message shown above appears on your phone.

Scenario #2:

Let’s say you are “old school” and didn’t email anything as in Scenario #1. Instead, you printed copies of your tax statements – or simply waited for them to arrive in the mail – and then dropped them off at your tax preparer’s office. A couple days later, your tax preparer calls and says, “we’re all set, I just electronically filed your return and the IRS has accepted it”. Hours later, you receive the same text message.

What happens next?

How do you know the text is not actually from the IRS? In this case, there are two ways to tell, the first being the most important to remember:

- The IRS does not initiate contact via text message or email. Even though the form referenced in message is indeed a form the IRS uses to verify identity, just not via text message or email.

- The “.com” web address. Any legitimate government agency website will end with “.gov”.

If you receive an email or text message like the one above, you can also report the phone number or email address to the IRS via the IRS website. So, to scratch that itch we all feel, here is one link you can click: https://www.irs.gov/identity-theft-central

Kovitz and its advisors do not provide tax advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax advice. You should consult your own tax advisors before engaging in any transaction.

Posted by

Kovitz