IDEA-IN-BRIEF

In anticipation of the end of 2023 and the start of a new year, we present these seven tax strategies designed to minimize taxes and enhance savings. Each strategy is detailed with an overview, examples, eligibility, limitations, and specific scenarios where they are most effective.

INTRODUCTION

As the year 2023 winds down, investors and taxpayers are seeking ways to reduce tax burdens and increase savings. Here are six essential tax strategies for year-end planning along with one new strategy for 2024. Each includes real-world applications, underlying logic, and important considerations.

1. Maximizing Annual Gift Tax Exclusion

Overview: The annual gift tax exclusion permits gift tax-free asset transfers to reduce your estate without affecting your lifetime gift tax exemption.

Example: In 2023, any person can gift up to $17,000 to another individual, free of gift tax. A married couple wanting to gift the maximum amount could combine each of their individual maximum amounts to give $34,000 to as many people as they desire. For example, if a couple has 5 grandchildren, they could give away $170,000 without any gift tax consequences. The 2024 annual gift tax exclusion will be $18,000 (married couples $36,000).

Limits/Exceptions: Gifts above $17,000 (or $34,000 as a couple) per recipient will require filing a gift tax return and may reduce your lifetime estate and gift tax exemption. Keep in mind, direct payment of tuition and medical expenses are not considered taxable gifts and are not subject to the annual limitation.

When Not to Use: If your estate is federally taxable, there is almost never a bad time to make annual exclusion gifts.

Next Steps: As always, consult your financial advisor and tax professional before making these annual gifts. Our team is prepared to assist you in navigating annual gift tax exclusion nuances.

2. Enhanced Capital Loss Harvesting

Overview: Strategically selling investments for a loss to offset capital gains can reduce tax liabilities. Net capital losses can also offset up to $3,000 of the current year’s ordinary income. The unused excess net capital loss can be carried forward to use in subsequent years.

Example: Suppose you bought 1000 shares of Company A stock for $50 per share in January 2023, and the price dropped to $40 per share by December 2023. You also bought 1000 shares of Company B stock for $30 per share in March 2023, and the price rose to $40 per share by December 2023. You decide to sell both stocks before the end of the year.

Here is how you can use capital loss harvesting to offset your capital gains:

You sell 1000 shares of Company A stock for $40 per share, resulting in a capital loss of $10,000 ($40,000 - $50,000).

You sell 1000 shares of Company B stock for $40 per share, resulting in a capital gain of $10,000 ($40,000 - $30,000).

You use the capital loss from Company A to offset the capital gain from Company B, resulting in a net capital gain of $0 ($10,000 - $10,000).

You pay no capital gains tax on the sale of both stocks, saving you money on your taxes.

You reinvest the proceeds from the sale of both stocks in a similar but not identical investment, such as a diversified index fund, to maintain your portfolio allocation.

Limits/Exceptions: Capital losses harvested must first offset gains of the same type, and the wash-sale rule (selling a security to capture a loss and then buying a similar security back within 30 days) can disallow a loss.

When Not to Use: If realizing the capital loss would not provide a tax benefit due to your income level or there are minimal capital gains to offset.

Next Steps: As always, consult your financial advisor and tax professional before harvesting losses. Our team is prepared to assist you in navigating capital loss harvesting. For example, using this strategy for short-term vs long-term capital losses may be more beneficial for your situation.

3. Roth IRA Conversions in Low-Income Years

Overview: Aligning retirement contributions and Roth IRA conversions during low-income years can enhance tax savings. Qualified Roth distributions are tax-free.

Example: A $15,000 conversion from a Traditional IRA to a Roth IRA during a low-income year can provide long-term tax benefits. By converting the money now, you pay taxes today, but all future growth within the Roth IRA is tax-free. Roth IRAs are not subject to required minimum distributions when you come of age. A $15,000 conversion today would be subject to federal and/or state taxes, however, if that converted account were to grow to $50,000 in the future, the $50,000 could be tax-free. Some states, such as Illinois, also exclude retirement income (Roth IRA conversions included) from state income taxes.

Limits/Exceptions: Roth conversions are irreversible.

When Not to Use: In years when your income is not substantially lower than usual. One should also keep in mind that the Tax Cuts and Jobs Act (TCJA) of 2017 is scheduled to sunset at the end of 2025, and if no new law is passed, certain tax brackets will see increases. These changes may alter when or how you utilize Roth conversions.

Next Steps: As always, consult your financial advisor and tax professional before the conversion. Our team is prepared to assist you with Roth IRA conversions.

4. Intra-Family Loans and Promissory Notes

Overview: Leveraging intra-family loans can facilitate estate planning and wealth transfer while minimizing taxes.

Example: A parent lends $450,000 to their child for 10 years at the current Applicable Federal Rate (AFR). The child uses the loan to buy stocks and bonds and pays back the parent over time. If the stocks and bonds appreciate in value more than the interest rate charged, there is a benefit from the difference, and the parent will effectively transfer some wealth to the child without using any of their lifetime gift tax exemption. Making this an even stronger strategy, charged interest can be forgiven under the annual gift tax exclusion.

Limits/Exceptions: Strict IRS rules apply, and interest rates must meet or exceed the AFR to avoid gift tax implications.

When Not to Use: If there is a low likelihood of the assets (purchased with the loaned money) outperforming the loan interest rate, or if you need the loaned funds.

Next Steps: Consult your financial advisor, attorney and tax professional before making the loan. Promissory notes will be needed. Our team is prepared to assist you with family loans.

5. Amplify Deductions Through Charitable Giving

Overview: Charitable donations can provide sizable tax deductions, especially for those who itemize, blending philanthropy with tax efficiency.

Example: Gifting $3,000 to a qualified charity, if itemizing deductions, can decrease your taxable income by an equivalent amount. If considering a larger donation, or donations across consecutive years, one might consider setting up a Donor Advised Fund (“DAF”) to maximize the tax deduction within a single year. A DAF is a public charity program that allows a taxpayer to make fair market value contributions to the fund, and thus avoid capital gains taxes on the appreciated securities contributed to the DAF, while receiving a tax deduction for the contribution. Once the DAF is funded, the taxpayer will then make recommendations for distributing the funds to qualified nonprofit organizations. A DAF is a flexible way to donate over time while enjoying an immediate tax benefit now.

Limits/Exceptions: Deduction limits depend on the type of charity and the taxpayer's adjusted gross income.

When Not to Use: If you don't itemize, the direct tax benefit will be limited or non-existent.

Next Steps: Consult your financial advisor and tax professional before making large charitable contributions because you have options. Our team is prepared to assist you with your charitable giving needs.

6. Investing in Qualified Opportunity Zones

Overview: Investments in Qualified Opportunity Zones (QOZs) can offer significant tax benefits, including deferral of capital gains taxes, as well as the possibility of tax-free growth for investments held over 10 years.

Example: If you invest $50,000 of realized short- or long-term capital gains from selling a business or other asset—be it equities, real estate, real property, or alternatives like art or rare coins, into a QOZ through the end of 2026, you could defer the tax on those gains for 10 years, and potentially eliminate taxes on gains accrued from the QOZ investment.

Limits/Exceptions: The tax benefits apply only to capital gains reinvested in QOZs within 180 days of the sale of the original asset. The tax deferral ends on December 31st, 2026, and there are specific requirements around tax reporting. Note that the investor will pay the prevailing 2027 tax rates.

When Not to Use: If you require liquidity, as QOZ investments should be considered long-term investments. Also, if you are not comfortable with the risks associated with investing in potentially underdeveloped areas.

Next Steps: Consult your financial advisor and tax professional for QOZ opportunities. Our team is prepared to assist if interested.

7. Conversion of Extra 529 Plan Assets to Roth IRAs under the SECURE 2.0 Act

Overview: The SECURE 2.0 Act, part of the Consolidated Appropriations Act of 2023, introduces a transformative option for 529 educational savings plan account holders. Starting in 2024, it's possible to roll over funds from a 529 plan into a beneficiary's Roth IRA, offering a new method to manage and utilize extra savings previously earmarked for education expenses.

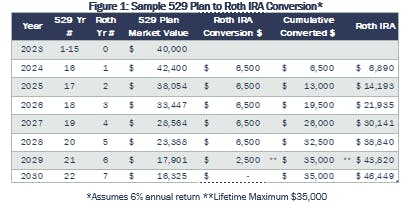

Example: This change (beginning in 2024) provides a valuable avenue to enhance the utility of your 529 plans, especially beneficial for those with remaining funds after educational expenses have been paid out. It introduces opportunities for financial flexibility and tax-advantaged growth for your family. See below a sample 529 Plan to Roth IRA Conversion.

Limits/Exceptions:

· Eligibility: To qualify, the 529 plan must have been open for a minimum of 15 years. Any contributions made within the past five years (and earnings on the contributions) are ineligible to be moved into the Roth IRA. The Roth IRA must be in the name of the beneficiary of the 529 plan. The beneficiary must have earned income. Note: It’s still unclear how 529 plans that have had multiple beneficiaries will be impacted by these rules.

· Lifetime Limit: There's a cap of $35,000 per beneficiary for the total rollover amount.

· Annual Limit: The rollover each year is restricted to the lesser of the IRA contribution limit or earned income for that year, minus any other IRA (traditional or Roth) contributions made by the beneficiary.

Next Steps: While SECURE 2.0 provides increased opportunities for tax savings, everyone's financial situation is different. As always, consult your financial advisor and a tax professional to understand how this change applies to you. Our team is prepared to assist you in navigating this new option.

· Review Your Plans: An evaluation of your existing 529 plans will help determine the potential for rollovers.

· Rollover Process: Rollovers must be conducted directly (either plan-to-plan or trustee-to-trustee). Beneficiaries can roll over funds irrespective of their income levels, although the rollover amount should align with the beneficiary’s earned income and Roth contribution limits.

CONCLUSION

The strategies discussed above are general guidelines and there are finer details and exceptions that might apply, as each client's situation is unique. We recommend consulting with tax professionals and wealth advisors to devise solutions tailored to your specific needs. At Kovitz, our team of wealth advisors, experienced in financial planning and tax strategies, is thoroughly prepared to guide you through these considerations. We are committed to ensuring that your financial strategy is robust, personalized, and aligned with the latest tax regulations and opportunities.

Interested in learning more? You can sign up for more Insights like this by Subscribing on this page.

REFERENCE

Journal of Accountancy, The new 529 rollover to Roth IRA. https://www.journalofaccountancy.com/news/2023/jul/the-new-529-rollover-roth-ira.html

Illinois CPA Society. Seven Tax Planning Strategies for Appreciated Assets. https://www.icpas.org/information/copy-desk/insight/article/digital-exclusives-2022/seven-tax-planning-strategies-for-appreciated-assets

Illinois CPA Society. 3 Secure 2.0 Changes to Discuss with Financial Planning Clients, https://www.icpas.org/information/copy-desk/insight/article/fall-2023/3-secure-2.0-changes-to-discuss-with-financial-planning-clients

Forbes. Maximizing Your 2023 Year-End Tax Planning Benefits. https://www.forbes.com/sites/matthewerskine/2023/11/06/maximizing-your-2023-year-end-tax-planning-benefits/?sh=1721af9e24f5

IRS, "401(k) Contribution Limit Increases for 2023," https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500

Fidelity, "Considering a Roth IRA Conversion," https://institutional.fidelity.com/app/item/RD_13569_13903/considerations-before-converting-to-a-roth-ira.html

Financially Speaking | Fall 2023 - "Innovative Estate Planning Strategies."

Charity Navigator, "Tax Benefits of Giving," https://www.charitynavigator.org/donor-basics/giving-and-taxes/tax-benefits-of-giving/

IRS, "Opportunity Zones," IRS; Origin Investments, https://origininvestments.com/what-are-the-potential-tax-benefits-of-investing-in-a-qoz/

Origin Investments, What are the potential tax benefits of investing in a QOZ,https://origininvestments.com/what-are-the-potential-tax-benefits-of-investing-in-a-qoz/

DISCLOSURES

Kovitz Investment Group Partners, LLC (“Kovitz”) is an investment adviser registered with the Securities and Exchange Commission. The information and opinions expressed in this publication are not intended to constitute a recommendation to buy or sell any security or to offer advisory services by Kovitz. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to participate in any trading strategy, and should not be relied on for accounting, tax or legal advice. This report should only be considered as a tool in any investment decision matrix and should not be used by itself to make investment decisions.

Opinions expressed are only our current opinions or our opinions on the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. The description of products, services, and performance results contained herein is not an offering or a solicitation of any kind; always consult with your tax advisor. Past performance is not an indication of future results. Securities investments are subject to risk and may lose value. Kovitz shall not be responsible for any loss sustained by any person who relies on this document.

Some alternative investments are limited to accredited or qualified clients. Not suitable for all individuals. Please consult with your financial advisor.

Posted by

Kovitz