If you expect your future income tax rates to be higher than they are today, it might be time to consider a Roth IRA conversion. But before you do it’s important to understand your tax rate.

Converting can be especially powerful for recent retirees who are not yet receiving Social Security benefits, and even more powerful when they haven’t started taking RMDs yet (which is now age 72 thanks to the SECURE Act). Additionally, the flexibility to choose your own schedule allows you to “optimize” the amount for tax purposes, since converting too much might push you into a higher tax bracket. Thus, we recommend converting smaller amounts each year to minimize your tax bill.

Reducing Your Tax Impact

It sounds simple enough but figuring out that optimal amount can be tricky. That’s because under our current tax system, qualified dividends and long-term capital gains are taxed separately from ordinary income, but nonetheless impact the “marginal” tax rate you’ll pay. The higher the amount of qualified dividends and long-term capital gains relative to your taxable income, the greater the impact. The type of income is important along with the amount.

For example, assume your clients are a recently retired married couple (both age 60) with the following sources of income:

+$25k of interest income

+$25k of qualified dividends

+$50k of portfolio long-term capital gains

= $100k Total Adjusted Gross Income (AGI)

Taxable Income= $74,900 (after taking the standard deduction of $25,100 in 2021)

For a married couple, this amount of income places them in the 12% income tax bracket. Knowing their income taxes will increase to 22% for income greater than $81,500 is important. They could convert $6,150 to a Roth IRA and still be within the 12% tax bracket.

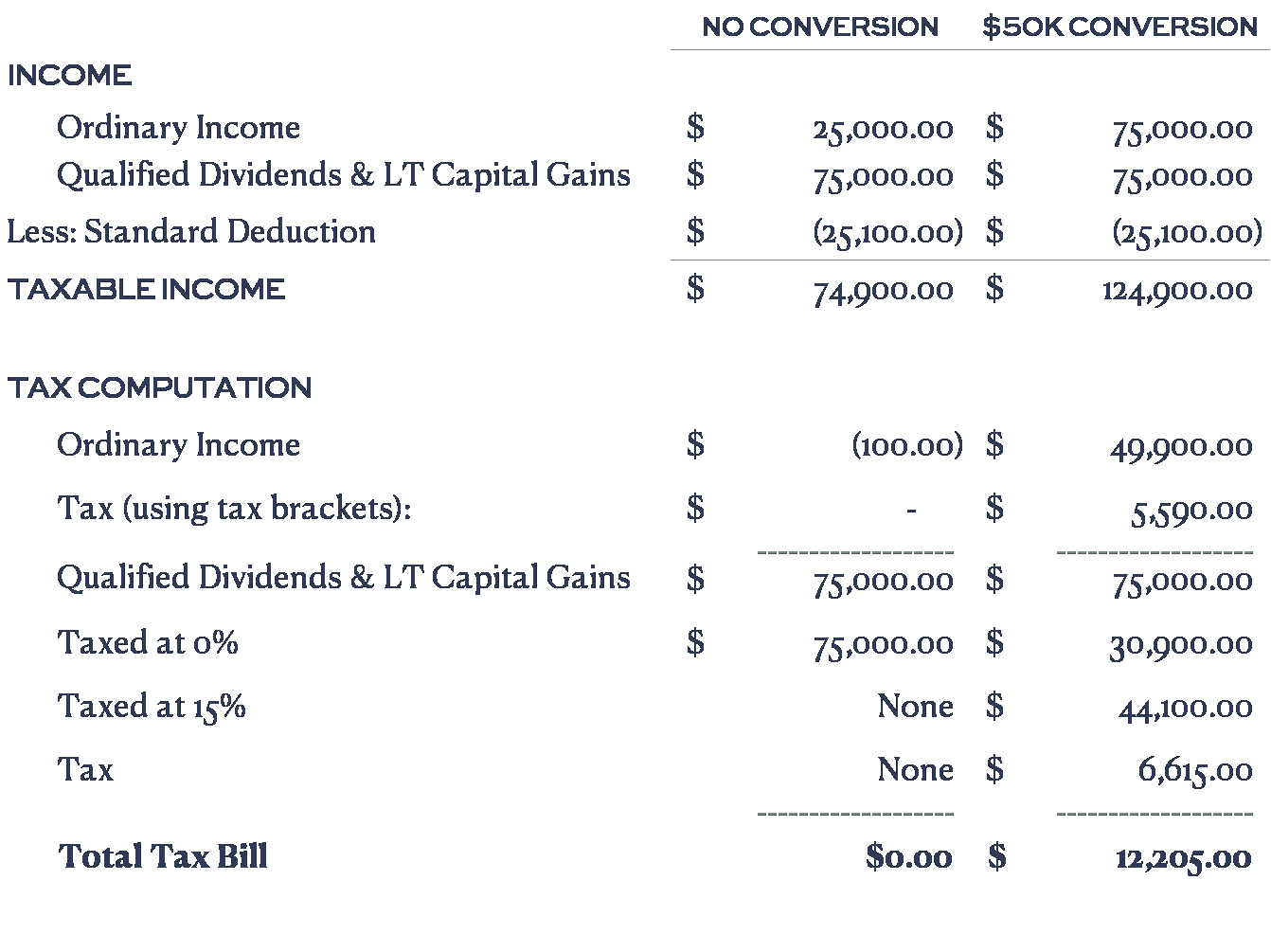

However, if the client decides to convert $50,000 from their Traditional IRA to a Roth IRA, is it correct to assume that the first $6,150 will be taxed at 12% and the next $43,850 will be taxed at 22%, giving us a total tax bill of $10,385 and a “blended” marginal tax rate of 20.7%?

Nope. The actual tax bill is $12,205 with a 24.4% marginal tax rate!!!

How can this be?!?!? It’s the type of income and amount that matter. For a married couple, the first $80,800 ($40,400 for single filers) of qualified dividends and long-term capital gains are taxed at 0%. Thus, our client pays $0 tax with $74,900 of taxable income since it all falls below the $80,800 threshold.

But when we add $50,000 of ordinary income from a Roth IRA conversion, their taxable income rises to $124,900 and the “ordinary” piece ($49,900k in this case) gets taxed at the marginal rates. Furthermore, the $75,000 of qualified dividends and long-term capital gains is now taxed differently. The amount taxed at 0% is reduced to $30,900 ($80,800 threshold - $49,900 ordinary income), with the remaining $44,100 now taxed at 15%. As a result, the true “marginal” rate is a combination of the two. See the tax computation in the summary below:

Some common themes to note:

- A client’s “tax bracket” and “marginal” tax rate when doing a Roth Conversion aren’t always the same!

- In fact, they’re only the same when the client has $0 income from qualified dividends and long-term gains -or- when the “ordinary” piece of their taxable income already exceeds the 0% rate threshold.

- Recent retirees who haven’t started receiving Social Security and taking RMDs will have the greatest opportunity to convert.

- That said, they’re also most likely to have different “marginal” tax rates than their tax brackets suggest.

In conclusion, the calculation is complex! Since every client’s tax situation is unique, we need to look at it on a case-by-case basis. The good news is that your Kovitz Financial Advisor can help you navigate these complexities and determine how and when to pursue a Roth Conversion.

Contact us today to learn more!

Posted by

Kovitz