Market & Performance Summary

A new chapter in the bond market began in September when the Federal Reserve officially turned the page on an era of restrictive policy by cutting the target fed funds rate 50 bps, from 5.5% to 5%. This rate cut is part of a broader effort by the Fed to balance its goal of controlling inflation while maintaining strong employment levels. With the Fed guiding toward another 175 bps in cuts through 2025, this move is seen as the start of a longer easing cycle, which could have significant implications for bond markets.

This cut is unusual because the Fed typically lowers rates when the economy is clearly weakening. However, the U.S. economy is still showing solid growth, with the 4.1% unemployment rate still near historic lows and inflation running above the Fed’s 2% target.[1] The rate cut is seen as a proactive measure to ensure continued economic stability, but it also raises questions about what’s next for fixed income investors.

So far, the bond market has responded positively to the turn in the interest rate cycle. The widely quoted Aggregate Bond Index returned 5.2% in the third quarter, largely driven by falling interest rates. This strong performance has helped push year-to-date returns to 4.5%, offering some relief after a challenging period for bonds earlier in the year. The flip side is that with higher prices come lower future expected returns. The yield on the Aggregate Bond Index fell from 5.0% to 4.2%.[2]

As always, our goal for the core of client fixed income portfolios is to preserve capital. We think that fixed income investors are best served by focusing on income generating assets with modest terms to maturity. Given strong corporate and municipal fundamentals, we believe focusing on higher yields than Treasuries can offer a prudent means to enhance returns within fixed income allocations, especially during a period when valuations are elevated across riskier asset classes. This conservative approach ensures stability and income, keeping client portfolios well-positioned to take advantage of an evolving market environment.

To Extend or Not to Extend

One of the biggest questions for bond investors right now is whether it’s time to extend duration in anticipation of further Fed rate cuts. When interest rates drop, bond prices rise, and this impact is especially pronounced for long-term bonds. This is because longer-duration bonds lock in fixed coupon payments for a longer period, making them more valuable when rates fall. This dynamic has made long-term Treasuries one of the better performing asset classes the year following the first rate cut in the cycle.[3]

Naturally, in investing, the answers are seldom as straightforward as they seem.

While the Fed has control over short-term rates, long-term rates are driven by a confluence of forces: market expectations, inflation, and supply and demand. Since the September rate cut, the yield on 30-year Treasury bonds has risen by 20 bps to 4.1%, which is the opposite of what some might expect. Part of the explanation is expectations. The yield curve has been inverted, meaning short-term rates are higher than long-term rates, for over two years, indicating the bond market was already expecting that the Fed would cut rates at some point. Since the actual cut in September, this steepening of the yield curve suggests that while the Fed is lowering short-term rates, investors are expecting higher inflation or stronger economic growth down the road, which can drive long-term rates higher.

The risk of extending duration too far is heightened by several factors:

1. There’s a risk that the Fed started cutting too soon. The U.S. economy continues to show resilience, with robust employment data and inflation still running above the Fed’s 2% target. This suggests that the Fed may be cutting rates too soon. Should inflationary pressures persist or reaccelerate, long-term bonds would suffer accordingly.

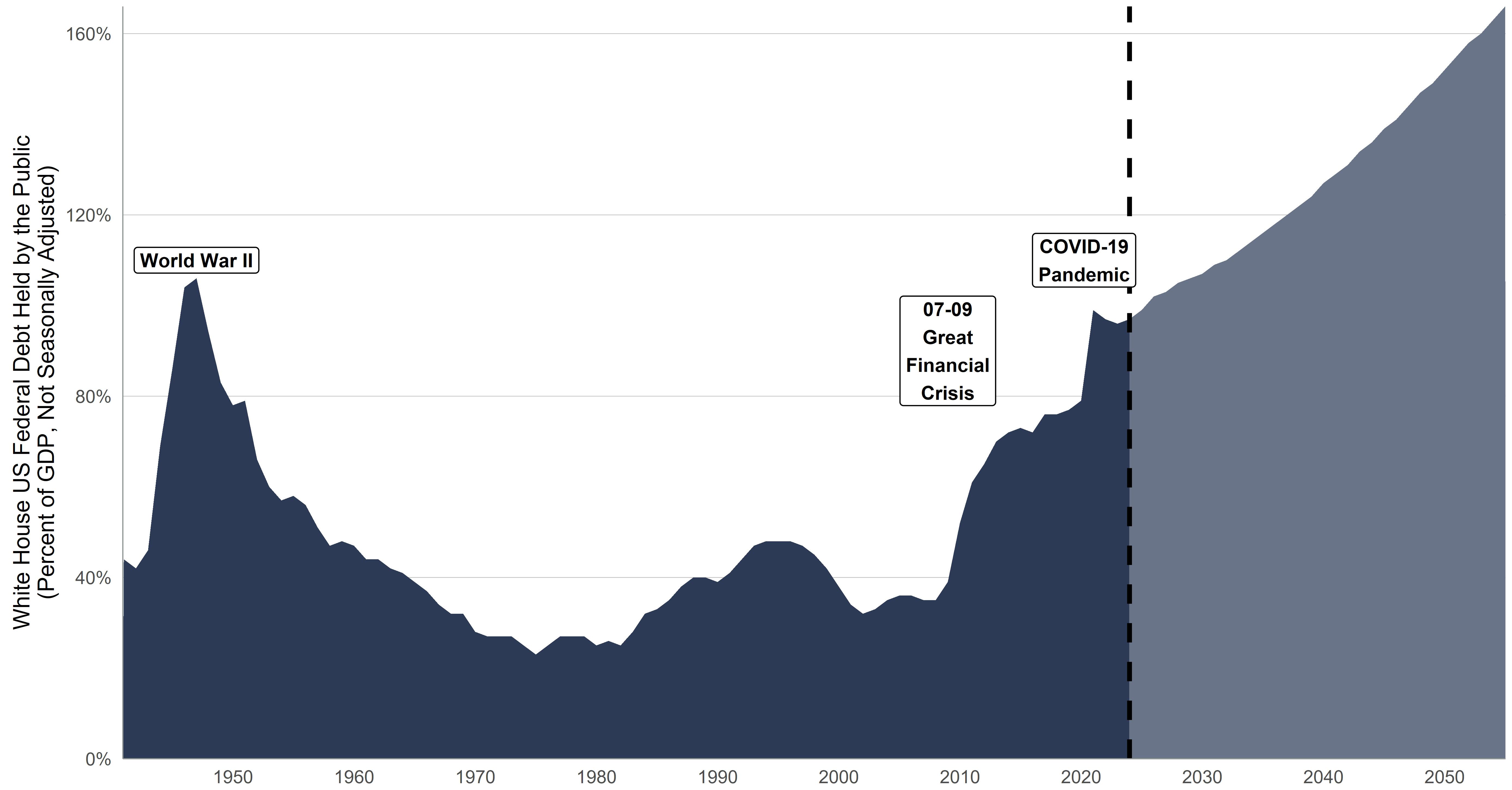

2. Fiscal policy is creating an unfavorable supply and demand imbalance. The U.S. government is currently running a nearly $2 trillion deficit, and projections indicate that the national debt could approach 200% of GDP by 2054.[4] This growing fiscal imbalance increases the supply of long-term government bonds, which reduces their attractiveness unless yields rise to compensate for the added risk. In other words, the more debt the government issues, the higher the term premium that investors will demand to hold these bonds, further pushing up long-term yields.

Figure 1: Federal Debt Held by the Public

Debt increases in relation to GDP, exceeding any previously recorded level in 2029 and continuing to soar through 2054. It is on track even more thereafter.

From 12.31.1940 through 12.31.2054. The data in this chart appeared in the Long-Term Budget Outlook: 2024 to 2054 report. Source: Kovitz using data from the Congressional Budget Office.

3. Correlation is different than causation. Over the last few decades, Fed rate cuts have come in response to severe economic conditions or imminent recessions. However, this time, the Fed appears to be cutting preemptively. In past cycles, long-duration bonds benefited from rate cuts because they coincided with periods of economic slowdown when investors were flocking to safety. As the industry saying goes, past performance is no indication of future results. We don’t believe outperformance from long-duration bonds should be a foregone conclusion this time around.

4. Compressed risk premiums amplify risks. The broader fixed income markets are offering meager excess yields to Treasury bonds with credit spreads hovering near historical lows. Tighter credit spreads are warranted in the near-term since the primary issuers in the credit markets, corporations and municipalities, are on solid financial footing, but perceptions can change quickly. If credit spreads widen, the downside risk to bonds, especially those with extended duration, will increase.

Figure 2: Credit Spreads

Source: Data 12/31/96 - 9/30/24: ICE BofA US Corporate, Government & Mortgage Index / ICE BofA US Corporate Index / ICE BofA US Cash Pay High Yield Index

Given these risks, it’s important for investors to remain cautious. While the Fed’s rate cuts signal that it may be time to move some cash off the sidelines, the more critical decision is how far to extend. The current environment suggests that a modest extension of duration—toward intermediate maturities—offers a better risk-adjusted opportunity than fully committing to long-term bonds. By maintaining exposure to high-quality, intermediate-duration assets, investors can capture yield benefits while mitigating the risks of straying too far from the sidelines.

Conclusion

The bond market is entering a new phase with the Fed’s rate cuts, and while this shift creates opportunities, it’s not without risks. While falling short-term rates may continue to support bond prices, it’s important to recognize that risks are still present—especially for those extending too far on the duration spectrum. We believe a balanced approach that focuses on income generation from intermediate-term, high-quality credits is an all-weather strategy for core fixed income investors that should position clients well for the chapter ahead.

[1] Measured using the Bureau of Labor Statistics US Unemployment Rate and the US Personal Consumption Expenditure Core Price Index as of 8/31/24.

[2] Measured using performance and yield-to-worst on the Bloomberg US Aggregate Bond Index.

[3] BlackRock article “The Fed has started cutting interest rates. Now what?” dated 9/18/24.

[4] Congressional Budget Office report “The Long-Term Budget Outlook: 2024 to 2054” dated 3/20/24.

DISCLOSURES

Kovitz Investment Group Partners, LLC (“Kovitz”) is an investment adviser registered with the Securities and Exchange Commission. The information and opinions expressed in this publication are not intended to constitute a recommendation to buy or sell any security or to offer advisory services by Kovitz. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to participate in any trading strategy, and should not be relied on for accounting, tax, or legal advice. This report should only be considered as a tool in any investment decision matrix and should not be used by itself to make investment decisions.

Opinions expressed are only our current opinions or our opinions on the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.