In this commentary, we will first examine the performance of Core Equity in relation to the S&P 500 benchmark, offering insights into our strategic positioning in the 2023 financial market. We will then provide a recap of the year's market dynamics, followed by a summary of our portfolio performance and activity. Concluding the commentary, we will reflect on the wisdom of the late Charlie Munger, highlighting his enduring impact on our investment approach

Market Summary

During the fourth quarter of 2023, the Kovitz Equity Composite[1] (the “Composite”) increased by 10.41%, net of fees. By way of comparison, the S&P 500 was up 11.69%, while the Russell 1000 Value Index rose 9.50% for the same period. For calendar year 2023, the Composite returned 26.77%, while the S&P 500 and the Russell 1000 Value rose 26.29% and 11.46%, respectively.

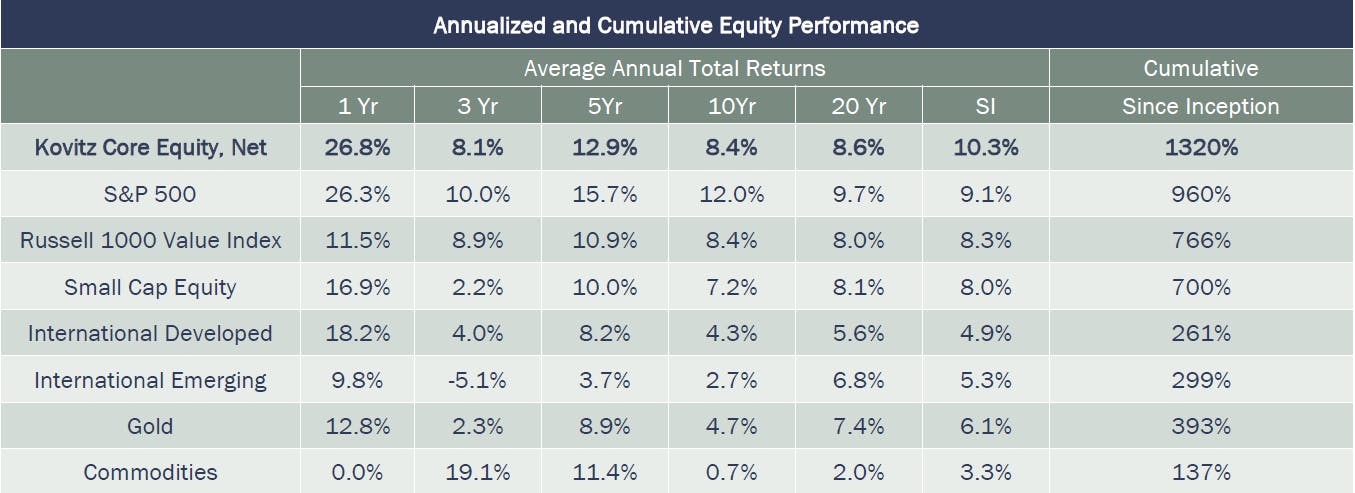

Since its inception on January 1, 1997, the Composite’s equity capital has compounded at a rate of 10.33% annually, versus 9.14% for the S&P 500 and 8.33% for the Russell 1000 Value Index. The Composite’s total return from inception is 1,320%, versus 960% for the S&P 500 and 766% for the Russell 1000 Value Index.

--------------------------------------

By most measures, the 2023 return of the S&P 500 Index was exceptional. However, the exceptional returns were unevenly distributed and accrued to an extraordinarily narrow group of stocks. For instance, 359, or 72%, of the 500 constituents underperformed the return of the index[2]. This was the largest percentage of laggards since the technology bubble of 1999[3]. Even more telling, 157 companies, or 31%, showed declines in the year2.

Such disparities exist by virtue of the S&P 500’s market capitalization-weighted structure, where larger companies have more of an impact on their return than smaller ones. For 2023, the bulk of the year’s index return was driven by the outsized contribution of the 7 largest stocks by market capitalization (dubbed graciously as the Magnificent Seven[4]). These 7 stocks made up almost 30% of the total weight of the index and were up an average of 112%2.

To illustrate the giant-sized impact these 7 companies had on the returns of the index, we can compare it to an index made up of the same companies but using equal weights for each of its components as opposed to market caps. Looking at the results of the two, some stark differences arise in the return profiles. For the equal-weight version, assuming you bought the same amount of each of the same 500 stocks at the beginning of the year and held them throughout, the return was a positive 16.4%, or almost a full 10% below the return of the market-cap-weighted version.

Another way in which the market showed divergent paths was that the return of growth stocks, as measured by the Russell 1000 Growth Index, beat the return of value stocks, as measured by the Russell 1000 Value Index, by approximately 31% for the year. The only other times a disparity this wide existed in the last 30 years was in the COVID year of 2020 and the 1999 bubble year, both periods of widespread speculation. Given that we’re bottom-up, fundamental investors with a value bias, we are pleased with our results for 2023. We also believe it bodes well for our relative performance looking forward, as we’ve historically witnessed rebounds in our relative performance after such wide gaps.

--------------------------------------

The primary reason the stock market performed so well in 2023 is that many believe that the U.S. economy is approaching a so-called “soft landing”, where inflation is returning to its pre-pandemic norm without sparking a recession or even much economic weakness. Most economists had thought such a scenario was either unlikely or impossible. Were it to come to fruition this time, it would be even more remarkable that the Federal Reserve waited to begin lifting the Federal Funds rate until the worst of the COVID disruptions were in the past, causing a full-year delay between rising inflation and its first-rate hike.

As inflation reports showed price pressures have broadly cooled since June, it seems the Federal Reserve has become increasingly confident that they may not need to keep raising interest rates to defeat inflation, which they have heretofore been reluctant to admit. Still, their public rhetoric continues to state they want to see more evidence that inflation readings remain subdued and that the economy and hiring are continuing to slow before they declare any sort of victory. They also remain hesitant to discuss the potential reversal of any of their barrage of interest rate hikes, 11 in all, totaling 5.25%, since March 2022. However, their own published expectations indicate that cuts in the Federal Funds Rate could begin at some point in 2024.

Regardless of the Fed’s attempt at sobriety, the market seized upon this as a “pivot” in their “hawkishness” and has begun to speculate that they are done raising rates this cycle. Bond markets have even begun to price in several rate cuts taking place potentially as early as March 2024. As evidence, the benchmark 10-year Treasury yield briefly topped 5% in mid-October but has subsequently fallen back through the 4% mark to end the year at 3.9%, one of the swiftest declines in rates we’ve witnessed. Interest rates are a key input to the pricing of assets and have an inverse relationship to one another. In this case, rapidly falling rates since the October top have caused a rapid increase in the values of both stocks and bonds.

While the inflation and economic readings have generally been good news, the lagged effects of higher interest rates could still slow the economy and potentially push it into recession at some point down the road. Or the rapid decline in market yields, which has the effect of reducing borrowing costs, may make it harder for the Fed to keep economic growth slow enough to finish the inflation fight. Nonetheless, investors will be watching closely for any new developments that could cause the Fed to update its stance on rates. If rate cuts don’t come as expected, the likely reaction by the market will be disappointment and a predictable emotionally driven sell-off of unknown duration. However, we believe the only thing an investor has any hope of controlling is his or her own emotions, and the extent, they are successful in doing so will likely be the dominant determinant of their lifetime returns.

Our preferred method for controlling our reactions and keeping from going into emotional overdrive is to think probabilistically. That is, we view the portfolio under a range of scenarios ahead of any actual developments. Thinking in this manner helps us avoid overly optimistic predictions based heavily on hope or preference. Today, we see three distinct economic possibilities over the medium term: 1) no recession, 2) a typical recession, or 3) a severe recession. Under the “no recession” scenario, we believe our portfolio looks attractive as many of our more cyclical businesses seem to be pricing in a recession already. Furthermore, several of our non-economically sensitive businesses did not participate fully in the 2023 stock rally, and we see good return potential in those names, which we added to over the course of the year. In the “typical, garden variety recession” scenario, we believe our portfolio earns average returns as the margin of safety we have built-in cushions much of the downside. A more severe recession would likely deliver below-average returns, yet we would expect the margin of safety built into our valuation work to insulate the portfolio from loss relative to the overall market. The upside to this most pessimistic scenario is that we would likely be eager buyers of stocks as we look beyond the downturn and price stocks according to what we believe earnings in a more normalized environment would look like. As in most dire market situations, we believe it’s extremely important not to consider stock price declines as “losses” but temporary setbacks on a path to attractive, yet somewhat lumpy, risk-adjusted returns.

PERFORMANCE SUMMARY

The table below summarizes annualized and cumulative performance for the Composite[5] as well as results for the S&P 500 and other benchmarks over standardized time periods beginning on January 1, 1997, and ending December 31, 2023.

Annualized and Cumulative Equity Performance

Source: Bloomberg Finance, L.P.

PORTFOLIO ACTIVITY

During the quarter we added to 6 positions while reducing 5 positions. We did not initiate any new positions and exited one position. The general theme of these portfolio changes was that the outperformance of several mega-cap technology companies (as discussed above) vs. the rest of the market this year has provided what we believe is an opportunity to allocate capital to businesses with cheaper valuations while maintaining our focus on quality. We believe these modifications improved the prospective growth of the portfolio.

Initiated: None

We did not initiate any new positions during the quarter.

Increased: Becton Dickinson, Diageo, Dollar Tree, Keysight Technologies, Lowe’s, and Paccar

Becton Dickinson

Healthcare stocks, in general, materially underperformed the market averages, with the whole sector up only about 2% for the year. Becton Dickinson (BDX) was no exception despite decent revenue growth in the mid-single-digits and about 10% earnings growth (on a constant currency basis). While both were generally in line with our expectations, Becton’s latest earnings report included guidance that the consensus found wanting in the near term, which caused a negative reaction in the shares. Our assessment is that transitory factors are impacting near-term earnings as they have to do primarily with foreign currency movements, a planned one-time inventory reduction, and spending to ramp up commercial activities behind the recently re-introduced Alaris hospital pump. The latter two items should yield accelerating cash earnings growth as fiscal 2024 progresses.

Using the relevant valuation multiples, Becton Dickinson stock is trading several turns lower than its peer group. Its balance sheet is in sound shape, it has good revenue and new product momentum, and the next couple of years look bright from a growth perspective.

Diageo

We continued to build our position in Diageo in the quarter. While spirits sales are soft as retailers and distributors normalize their inventories after building them throughout 2022, we think the valuation of the stock accounts for this period of weakness. We met with Diageo’s management during the quarter and concluded that they are appropriately investing in their brands while otherwise managing the business prudently. We expect supply chain cost relief to begin to positively impact profit margins when the second half of 2023 results are reported early next year and expect this dynamic to continue throughout 2024. Meanwhile, although certain geographies are seeing some weakness, including South America, which caused a near-term negative earnings revision for Diageo in the quarter, we continue to view our investment thesis as intact. This includes what we communicated earlier this year: spirits are taking share within the total alcoholic beverage market, premium brands are growing faster than standard brands, the business is very resilient to economic cycles, and Diageo is a leader in two of the fastest-growing categories – Scotch and tequila. Meanwhile, consumer staples stocks had a weak year in 2023, and Diageo stock was no exception. The stock now trades at a 10-year low price-to-earnings ratio.

Dollar Tree

The dollar store industry had a tough 2023 as difficult customer economic conditions and operational challenges at stores produced choppy results. SNAP (Supplemental Nutrition Assistance Program, often referred to as “food stamps”) benefits were down as COVID-era support programs waned from emergency allotment levels back to normal levels as of March 2023. As of the third quarter, Dollar Tree (DLTR) management reported that SNAP benefits were down 23% on a year-over-year basis for customers that were recipients. With the diminished SNAP benefits, customers’ spending at dollar stores shifted from discretionary items to staples, the latter which carry lower profit margins for the stores. Moreover, retail theft, or shrink, has been a particular problem in the dollar store industry, and both Dollar Tree and competitor Dollar General reported a negative impact on profits from elevated shrink.

Dollar General had a more difficult year than Dollar Tree. Industry conversations inform us that Dollar General had cut its expenses to a depth that impaired its profit-generating muscle, and negative customer traffic was a problem there for much of the past year. Dollar Tree’s retail concepts, Dollar Tree and Family Dollar, seemed to gain some market share from Dollar General’s difficulties. This helped to set up a buying opportunity in Dollar Tree stock in the fourth quarter after its stock traded down in sympathy with a disappointing Dollar General earnings report. We assessed Dollar Tree’s results to have been positive during this time, as indicated by solid traffic and same-store sales, progress on store remodeling, and strong new customer acquisition. Deeming our investment thesis intact when evaluated over a multi-year time horizon, we used the late 2023 stock price weakness to add to our position. By late December, the stock had recovered almost all its swoon from earlier in the quarter.

Keysight Technologies

We continue to incrementally add to Keysight. We have written extensively about this name in prior communications.

Lowe’s

Lowe’s stock posted a solid if unspectacular return of roughly 14% in 2023, but the path was not linear. All year, observers debated whether the low housing turnover in the U.S. is a transitory lull that has been through its worst days or the early innings of a more substantial housing price correction. Both low housing turnover and a material price correction would be bad for the home improvement industry, but a mere cycle wouldn’t. We don’t know exactly when existing home sales will pick up from trough levels, but we’re confident they will at some point over the next few years.

The economy has a way of correcting back to longer-term averages in a category like existing home turnover, particularly with millions forming new households each year. We also don’t know if house prices will correct more, or more broadly, than they did in certain regions (the West and Southwest, specifically) in 2023, although we feel strongly the trend will have a strong correlation to interest rates. We do feel reasonably confident that when Lowe’s stock was at its low prices for the year, a much worse case than the present one was priced into the stock. We felt this offered a margin of safety – that industry performance could get materially worse for a year or two – and the business value wouldn’t be much worse than what the market was pricing as of October 2023. We used this price weakness to add to our weighting in Lowe’s stock.

When Lowe’s closes its books on Fiscal Year 2024 in January, it will have had two consecutive years of negative same-store sales and three consecutive years of negative traffic, albeit starting from elevated COVID-era levels. Our work shows that traffic is below pre-COVID levels now. While we’re not willing to call the timing of the inflection, we think traffic at the stores will return to positive levels. The housing stock in the country continues to age with the average U.S. home over 40 years old (older homes require more maintenance), existing single-family home sales are at Global Financial Crisis levels, the S&P/Case-Shiller National Home Price Index is 47% higher than pre-COVID levels, and employment remains resilient. Mortgage rates are also now coming down from their 2023 highs. Lacking a severe economic shock, we believe the odds to be good that we’re progressing through a cycle in housing, and that Lowe’s stock was on offer at a reasonable price in the fourth quarter of 2023.

Paccar

We have owned Paccar (PCAR), the manufacturer of medium- and heavy-duty trucks under the Peterbilt, Kenworth, and DAF brands, for over a year. Our thesis of earnings power expansion driven by optimizing truck production and increased penetration of Paccar parts business has largely materialized. We respect the management team and family ownership, who continue to reinvest in the parts business, which is proving to be a more significant and less cyclical driver of profits. Despite the stock price increase, earnings power has grown faster, and we are adding to our position at an even cheaper relative valuation than when we initially invested.

Exited: Autodesk

Initiated during the depths of the COVID sell-off, Autodesk (ADSK) offers a broad suite of software that includes the de facto industry standard for computer-aided design (CAD) for the construction of buildings and products ranging from tools to create CGI for the entertainment and gaming industries to those used in product design for industrial, transportation, and consumer end markets. Trading near its high for the year, we felt the company’s progress towards increasing the proportion of direct sales (vs. sales through third-party resellers), converting multi-year contracts to annual contracts (better pricing and cash flow transparency), and cracking down on non-compliant users was largely reflected in the share price and this equity capital could be used for potentially higher return alternatives.

Trimmed: Apple, Alphabet, Meta Platforms, General Motors, Gildan

Apple

As of December 31, 2023, Apple (AAPL) is the largest company in the world by market capitalization, and for good reason; 2023 free cash flow will likely come in around $100 billion, which is larger than the market caps of over 80% of the companies in the S&P 500. Furthermore, its products and services have become the preeminent consumer staples in the world. However, despite our admiration for the company, we are finding better prospective returns elsewhere given it trades at a 40% valuation premium to the S&P500 despite somewhat lower growth expectations.

Alphabet and Meta

Alphabet (GOOG/GOOGL) and Meta (META) are both trading near their all-time highs. Though both companies have seen their moats attacked by credible competitors within the last year, they have largely come away with their market share intact or even better than before. Moreover, we are excited about both companies’ improved advertising products, which are resonating with commercial customers, and their management teams’ focus on expense discipline.

Still, for most accounts, these two companies have become outsized positions at a time when their valuations are not as materially discounted relative to our estimates of fair value. Further, unlike in prior economic cycles, they will not be as immune to economic volatility at this stage of their maturity profile. As such, we have chosen to reduce their weights to manage the position sizes and free up capital for our purchases.

General Motors

2023 was supposed to be a coming-out party of sorts for General Motors’ (GM) full lineup of electric vehicles. However, production issues earlier in the year and a prolonged strike by an increasingly aggressive union have delayed much of those plans to 2024. We still have an appreciation for GM’s strategy to build an EV platform from the ground up as opposed to modifying existing vehicles, the fact that they are one of two companies currently operating commercial self-driving vehicles, and that the shares are trading at less than 4x normalized core earnings excluding the ongoing investment in Cruise’s self-driving vehicle operation. However, with several factors outside their control clouding their ability to deliver on their EV transition strategy and attractive alternatives for capital available elsewhere, we reduced our position in GM.

Gildan

Gildan (GIL) announced that the founder, CEO, and 40-year veteran of the company, Glenn Chamandy, had left the company. Later that same morning, Mr. Chamandy later issued a statement indicating he had been fired without cause. The shares subsequently fell ~10% on this surprising news.

Mr. Chamandy’s termination points to a major disagreement over the direction of the company between him and the board. Making the timing more curious, this announcement comes on the heels of a quarterly report that showed the company was making progress lapping inventory destocking issues among the company’s retailer and distribution partners that had been pressuring results in 2023.

Given the uncertainty introduced by this sudden departure of an owner-operator CEO who was the driving force for the company’s strategic vision, we chose to reduce our position. After our sale, a number of large shareholders have initiated a campaign to reinstate Mr. Chamandy and oust the Board. We continue to assess additional information as we obtain it and weigh our options regarding the remaining position.

Charles T. Munger (1924 - 2023)

As many of you have no doubt read, Charlie Munger, Warren Buffett’s partner and friend for over 60 years, passed away on November 28th, one month shy of his 100th birthday. While we have learned so much from him about investing, equally as important was what he taught us about how to live a life well. Here are just a handful of nuggets attributed to him that we have taken to heart.

"In my whole life, I have known no wise people who didn’t read all the time - none, zero. You’d be amazed at how much Warren reads - and at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.” - Poor Charlie's Almanack

“Remember that reputation and integrity are your most valuable assets and can be lost in a heartbeat.” - AZQuotes.com Website

“It's so simple. You spend less than you earn. Invest shrewdly, avoid toxic people and toxic activities, and try and keep learning all your life.” - Poor Charlie's Almanack

“I constantly see people rise in life who are not the smartest… but they are learning machines. They go to bed every night a little wiser than when they got up and boy does that help - particularly when you have a long run ahead of you.” - 2007 USC Law School Commencement Address

“You don’t have a lot of envy, you don’t have a lot of resentment, you don’t overspend your income, you stay cheerful in spite of your troubles, you deal with reliable people and you do what you’re supposed to do. All these simple rules work so well to make your life better.” - 2019 CNBC interview

“If you have a reputation for being decent to work with and unselfish, you make more money, not less. And at Berkshire, I can’t tell you the things that we have bought where the people wanted a good home for something that they love and they trusted us to take care of their loved one… And so, so, good morals and a reputation for good morals are enormously valuable, and it’s just so simple…. The right way to go through life is a win-win. Just anything else is crazy. To be all take and no give is just an absolute disaster.” - 2019 Wall Street Journal Interview

“We say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control.” - Intelsense.com Website

--------------------------------------

[1] The returns for the equity portion of your individual account will differ somewhat from the Composite due to variations in account holdings, cash position, and other client-specific circumstances.

[2] Telemet pricing data and Kovitz Investment Group research.

[3] Richard Bernstein Advisors LLC and Bank of America Merrill Lynch US Strategy.

[4] The Magnificent Seven consists of Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla.

[5] The returns for the equity portion of your individual account will differ somewhat from the Composite due to variations in account holdings, cash position, and other client-specific circumstances. Please refer to the last page for a complete GIPS compliant presentation, along with important disclosures

DISCLOSURES

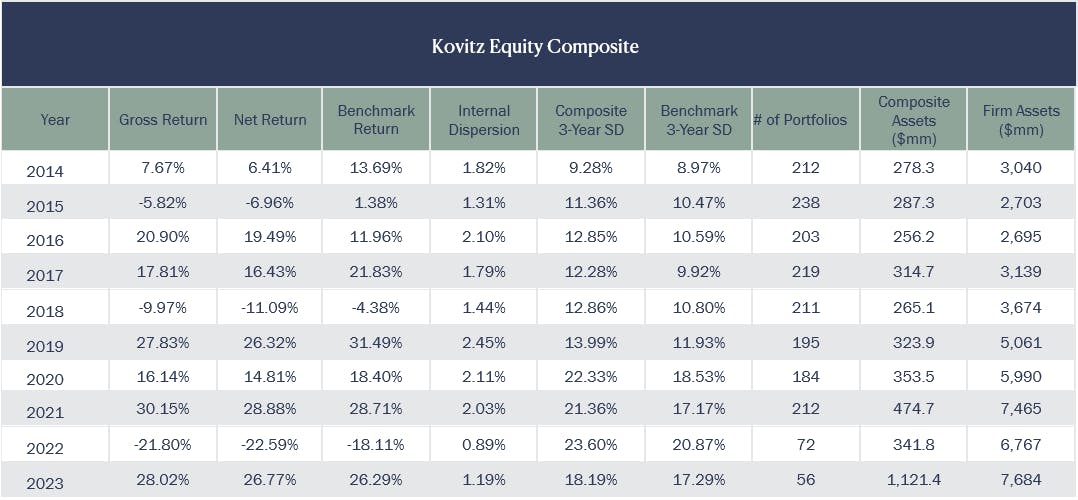

Fees: Gross-of-fees returns incorporate the effects of all realized and unrealized gains and losses and the receipt, though not necessarily the direct reinvestment, of all dividends and income. Gross-of-fees returns are presented before management fees, but after all trading expenses. Prior to October 1, 2020, Composite net-of-fees returns were calculated by deducting model investment management fees, which are defined as the highest, generally applicable fees of 1.25% of equity assets and 0.50% of cash assets, from the gross composite return. Beginning on October 1, 2020, the Composite net-of-fees returns are calculated by deducting model investment management fees, which are defined as the highest, generally applicable fees for the strategy of 1.00% of all composite assets. The firm’s current management fee schedule is as follows: 1.25% on assets below $1 million, 1.0% per annum for assets from $1 million to $5 million, 0.85% per annum on assets from $5 million to $10 million, 0.75% per annum for assets from $10 million to $20 million, 0.65% per annum for assets from $20 million to $35 million, 0.55% per annum for assets from $35 million to $50 million, and 0.50% per annum for assets over $50 million. Such fees are negotiable. Where applicable, the total bundled or wrap fee charged to each portfolio is dependent on the end client’s financial advisor and wrap sponsor. The composite includes accounts that do not pay trading fees.

Prior to January 1, 2010, the Composite included the performance of assets that had been “carved out” of multiple asset class portfolios. When calculating performance, a hypothetical cash balance for each month was allocated to the carve-out on a pro-rata basis relative to the portion of each portfolio’s assets that comprised the carved-out asset class. Beginning January 1, 2010, changes in the GIPS standards caused the Composite to be redefined and all carve-outs to be removed from the Composite. Carve-outs formerly included in the Composite continue to be managed in the same manner as they were before being removed from the Composite.

Definition of The Firm: Kovitz Investment Group Partners, LLC (Kovitz) is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940 that provides investment management services to individual and institutional clients. From October 1, 2003 to December 31, 2015, the Firm was defined as Kovitz Investment Group, LLC. Effective January 1, 2016, Kovitz Investment Group, LLC underwent an organizational change and all persons responsible for portfolio management became employees of Kovitz. From January 1, 1997, to September 30, 2003, all persons responsible for portfolio management comprised the Kovitz Group, an independent division of Rothschild Investment Corp (Rothschild).

Composite Definition: The Kovitz Equity Composite includes all fee-paying, discretionary portfolios managed to the Kovitz Core Equity strategy. The Kovitz Core Equity strategy utilizes a private owner mentality to purchase equity securities issued by companies with durable competitive advantages and strong balance sheets that are trading at a significant discount to their intrinsic value. The goal of this strategy is to maximize long-term total return. The Composite’s inception date is January 1, 1997. The Composite was created on January 1, 2001. Effective January 1, 2000, the Composite no longer included portfolios managed by a manager who made a change in investment style. The persons currently responsible for managing Composite portfolios have been primarily responsible for portfolio management throughout the entire period shown. The minimum portfolio size to be included in the Composite is $250,000 until December 31, 2021. Thereafter, the strategy minimum was raised to $1 million. Portfolios in the Composite may occasionally make use of leverage and/or derivatives, but such use does not have a material effect on Composite performance. The use of derivatives is generally limited to covered call writing, and uncovered option writing is never used.

The benchmark for the Composite is the S&P 500 Index. The S&P 500 Index is composed of 500 leading companies in the United States, covers approximately 75% of the market capitalization of U.S. equities, and serves as a proxy for the total market. The S&P 500 Index returns do not include the effect of transaction costs or fees and assume reinvestment of dividends into the index.

GIPS: Kovitz Investment Group Partners, LLC (Kovitz) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Kovitz has been independently verified for the periods January 1, 1997 through December 31, 2022. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Valuations are computed and performance is reported in U.S. dollars. The measure of internal dispersion presented above is an asset-weighted standard deviation. The three-year standard deviation presented above is calculated using monthly net-of-fees returns. The three-year standard deviation is not presented when returns of less than 36 months are available. The risk measures, unless otherwise noted, are calculated gross of fees. A complete listing of composite descriptions and policies for valuing portfolios, calculating performance, and preparing GIPS reports are available on request. The composite includes accounts that do not pay trading fees.

The description of products, services, and performance results of Kovitz contained herein is not an offering or a solicitation of any kind. Past performance is not an indication of future results. Securities investments are subject to risk and may lose value.