Market Summary

This quarter was marked by a “rotation of worry,” as each economic data release seemed to alternate between signs of weakness and strength. Reports indicating consumer weakness were followed by data showing consumer resilience. Inflation reports that suggested stubbornly high levels were countered by others indicating progress in the right direction. Rising unemployment claims were quickly followed by reports of falling claims. This back-and-forth resulted in increased volatility, both on the downside and the upside, throughout the quarter.

As the quarter began, optimism about the Federal Reserve's ability to engineer a “soft landing” gained traction, leading to a relatively strong performance in the equity markets during July. However, August brought one of the sharpest growth scares seen in some time. A weaker-than-expected payrolls report raised concerns that a recession might already be underway. The Dow plunged by over 1,000 points, marking its largest decline since September 2022, and extending a three-day slide that left the S&P 500 down roughly 6%. Speculation about a hard landing replaced hopes for a soft one, with some market participants even mentioning the possibility of an emergency rate cut by the Federal Reserve.

However, those fears were swiftly reversed when initial jobless claims fell to their lowest level since early July, and retail sales climbed by 1% in July, marking the largest increase since early 2023. Within a couple of weeks, the market not only recovered its early August losses but also posted gains beyond that, demonstrating the volatility and resiliency that characterized the quarter.

September began much like August, with another disappointing economic report reigniting growth fears, prompting the market to do what it does best— panic and send stocks lower. The S&P 500 endured its worst week since the collapse of Silicon Valley Bank over a year ago, which says as much about the relative lack of volatility over the past year and a half as it does about the events of this quarter. However, this negative sentiment quickly reversed as attention shifted to the Federal Reserve’s interest rate policy meeting and discussions over the size of the anticipated rate cut. After more than a year of maintaining rates at their highest levels in a quarter century, the Fed opted for a bolder-than-expected 50 basis point (½ percent) reduction in its benchmark rate, as opposed to the more commonly discussed 25 basis points.

This move likely marks the first in a series of rate cuts expected over the next couple of years. While the decision was not without controversy, the more aggressive cut suggests that the Fed has grown more comfortable with the inflation outlook and sees an opportunity to get ahead of potential labor market softening, in line with its dual mandate. It also alleviates concerns that interest rates were overly restrictive. Stocks responded favorably to the Fed's rate cut decision, with both the Dow Jones Industrial Average and the S&P 500 hitting all-time highs. In keeping with the theme of the quarter, however, nobody should be surprised if some new data point were to reverse these gains.

While the standard definition of volatility refers to the amount of variation in the rate at which stock prices increase or decrease relative to the average rate of change, in practical terms, volatility is the rate at which investors change their minds. Over the past quarter, market participants oscillated rapidly between euphoria and near-panic with each new piece of economic data, causing prices to fluctuate just as swiftly.

Periods like these serve to underscore the importance of maintaining an emotionally even keel in managing portfolios. Not every minor data fluctuation indicates a full-blown crisis, nor does it mean that the all-clear signal has been given. The uncertainty is understandable; nobody knows where the economy is headed, and economists and market watchers can hardly agree on where things stand right now. To paraphrase an old joke: economists spend half their time forecasting and the other half explaining why their forecasts didn’t pan out.

Nevertheless, markets are designed to make you feel uncomfortable: uncertainty and the associated volatility is exceedingly disconcerting. But learning to live – and thrive – despite this discomfort is one of the critical factors in generating substantial long-term compounded returns. Regardless of the accompanying volatility, ignoring the vicissitudes and vagaries of an economical reporting cycle must supersede the urge to give in to the folly of attempting to time the market’s ups and downs, which most often serves only to disrupt the inevitable long-term upward trend of equity markets.

The upshot of extreme short-term volatility is the opportunities that unfold. It was no coincidence that we had one of our most active quarters in recent times (discussed below in “Portfolio Activity”).

Performance Summary

During the third quarter of 2024, the Kovitz Equity Composite (the “Composite”) increased by 6.9%[1], net of fees. By way of comparison, the S&P 500 improved 5.9% while the Russell 1000 Value Index rose 9.4% for the same period. Year-to-date, the Composite is up 16.6%, while the S&P 500 and the Russell 1000 have risen 22.1% and 16.7%, respectively.

--------------------------------------

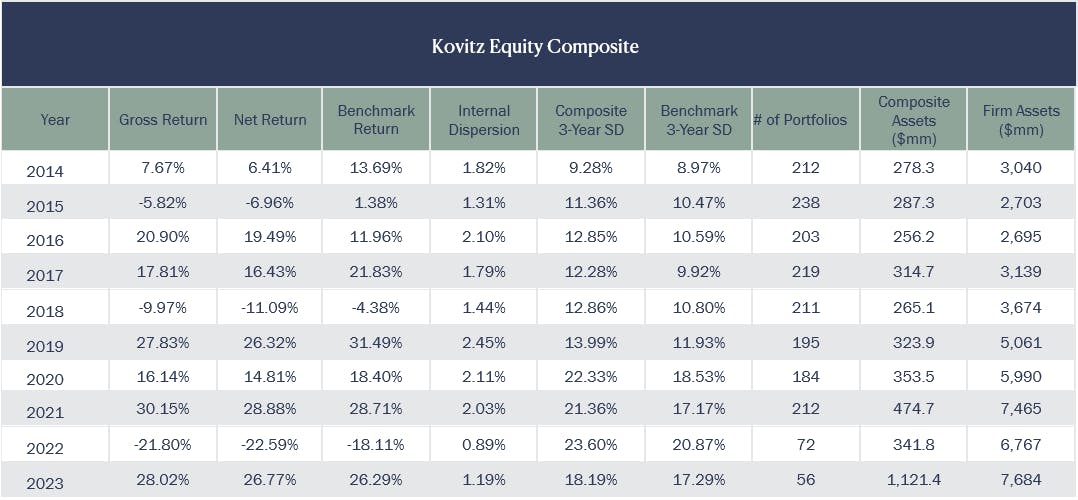

The table below summarizes the annualized and cumulative performance for the Composite, as well as results for the S&P 500 and other benchmarks, over standardized time periods from January 1, 1997, to September 30, 2024.

Since inception on January 1, 1997, the Composite has returned a net annualized rate of 10.6%, compared to 9.7% for the S&P 500 and 8.7% for Russell 1000 Value. Through the power of compounding, the Composite’s annual return translates into a cumulative total return of 1554.5% versus 1194.6% for the S&P 500 over the same time period. The respective cumulative return for the Russell 1000 Value Index has been 911.0%. In dollar terms, $10,000 invested in the Composite, the S&P 500 and the Russell 1000 Value at inception, would be worth $165,492, $129,459, and $101,101, respectively.

These numbers highlight two primary observations:

1) The compounding nature of annual returns is a powerful force.

2) Even seemingly small differences in annualized returns can have an outsized impact when measured over long time periods.

While it may be tempting to try to time the market by jumping in and out at seemingly opportune times, this approach is likely to yield returns far below those achieved through patience and by resisting the urge to “interrupt” the remarkable power of compounding.

Annualized and Cumulative Equity Performance

Source: Bloomberg Finance, L.P. Data as of 9/30/24.

Portfolio Activity

During the quarter, stock volatility provided opportunities to actively adjust our portfolio. We initiated three new positions and exited two. Additionally, we used valuation to rebalance our holdings, which should serve to improve the risk reward inherent in the portfolio. We selectively increased our holdings in 5 positions that we believed were trading at substantial discounts to our base case valuations, while trimming 7 positions in stocks that had approached our fair value estimates.

Our strategy remains unchanged: to maintain a balanced portfolio of above-average businesses trading at reasonable prices and to stay unfazed by the ups and downs of the economy, geopolitics, and financial markets.

Initiated: Applied Materials, Fiserv, and Universal Music Group

Applied Materials

Applied Materials (AMAT) manufactures equipment essential to fabricating semiconductors, a process that involves transforming a silicon wafer into an integrated circuit, or "chip"—arguably the most complex engineering challenge ever undertaken by humankind. To put this into perspective, the processor in recent generations of mobile phones—just one of many chips in the device—contains 15 billion transistors and about 65 miles of wiring.

Historically, progress in the semiconductor industry has followed "Moore's Law," an observation made by Intel co-founder Gordon Moore in the 1960s that the number of transistors on an integrated circuit would double approximately every two years. This advancement was driven primarily by making transistors smaller through lithography tools, which increased performance and reduced power consumption. However, as transistors near their physical size limits, further improvements in performance and power efficiency will require innovations in chip architectures, more complex manufacturing processes, and advancements in packaging technologies.

Applied Materials is uniquely positioned in the semiconductor equipment industry, offering the broadest range of solutions and co-developing innovations with its customers to continue the spirit of Moore's Law. The industry is highly consolidated, with substantial barriers to entry due to the technical complexity of the work and the long-standing relationships with customers. While sales may fluctuate year-to-year, we expect demand for Applied’s equipment to exhibit long-term growth above GDP levels, driven by rising demand for semiconductors and increasingly complex, capital-intensive manufacturing processes. Importantly, Applied Materials also derives about 20% of its revenue from its service business, providing maintenance and spare parts for the extensive installed base of equipment, adding stability to its revenue stream.

In addition to its durable competitive advantages, an investment in Applied Materials offers exposure to the secular growth driven by rising semiconductor demand and advancements in chip architectures for logic, memory, and packaging applications. Notably, this exposure is agnostic to which specific companies' chips succeed in various end markets. With Applied trading at discount to the S&P 500’s current multiple—we see this as a reasonable price to increase our exposure to the semiconductor industry through a leading company with strong management, a solid balance sheet, and attractive long-term growth prospects.

Fiserv

Fiserv (FI) is a financial technology company providing business operating systems software, payments software, and payments networks. Fiserv holds leading market shares in merchant acquiring among small and medium-sized businesses (SMBs) and in banking software, including core bank operating systems, digital banking, and card payments. Although you may not realize it, you have almost certainly interacted with Fiserv technology in your daily life, as the company claims to reach nearly 100% of U.S. households.

The key development at Fiserv is that its 2019 merger with First Data brought in a top-tier management team that has modernized the company’s technology offerings through increased organic capital spending and targeted bolt-on acquisitions. Fiserv now offers leading real-time, open architecture, cloud-hosted software solutions, which it will sell into its extensive installed base using the largest sales reach in the industry. These products are expected to see further adoption as business operating systems in the near term and through data analytics offerings over time. Additionally, the company is accelerating its international expansion.

Currently, Fiserv is experiencing a favorable dynamic where revenue is accelerating while capital spending is moderating, which typically bodes well for stock performance. The company’s revenue has historically shown resilience during economic downturns, management has provided guidance for healthy margin expansion, and the balance sheet has enabled an increase in share repurchases compared to the past two years. While Fiserv has started to gain recognition for its transformation, we believe this is still the early stages, with significant potential ahead. We think Fiserv stock offers an attractive risk-reward profile at this point.

Universal Music Group

We initiated a new position in Universal Music Group (ADR: UNVGY), funded primarily by the sale of our remaining stake in Spotify Technology (SPOT) (discussed below). Both companies are well-positioned to benefit from the ongoing shift towards streaming as the primary mode of music consumption and from customers' demonstrated willingness to accept price increases for these services.

However, with Spotify's shares up 82% year-to-date and nearly quintupling from their 2022 lows, combined with a sharp sell-off in Universal's shares following a recent earnings report, we saw an opportunity in these diverging share prices to materially increase expected returns under a similar set of assumptions regarding growth in streaming and overall music industry revenues.

Universal Music Group (UNVGY), a Dutch company spun off from the French entertainment conglomerate Vivendi in 2021, is the leading music record label company, boasting 9 of the top 10 global artists in 2023, including Taylor Swift. Universal’s primary business activities focus on helping artists and songwriters create and monetize intellectual property through various channels, such as touring, merchandise, placement in TV and films, vinyl sales, and, most importantly, streaming.

The rise of on-demand music streaming has significantly transformed the business model for record labels. Unlike the traditional revenue model, which relied heavily on one-time sales of physical media requiring extensive manufacturing and distribution, or digital downloads tied to specific devices or platforms, Universal now primarily generates revenue through the actual consumption of music on streaming platforms like Spotify and YouTube. This shift enables the monetization of older catalog music with minimal incremental costs to the record labels.

With the largest catalog of music and operating within an attractive oligopoly, alongside peers Warner Music Group and Sony, Universal is well-positioned to capitalize on the growing adoption and monetization of streaming.

Shares have declined by 7.5% since the company went public three years ago, as a combination of high expectations, uneven growth in streaming revenues, and disappointing margin progression has led to negative sentiment and earnings revisions. In its recently announced Q2 results, UMG reported weaker-than-expected streaming revenues, causing shares to fall by 25%. Following this sell-off, we believe this presents an opportune time to initiate a position. We think expectations are now more reasonable, the recent shortfall in streaming revenue is likely temporary with long-term demand trends remaining strong, and margins will improve as cost savings are realized, and the business mix shifts increasingly towards higher-margin streaming revenues.

Increased: Dollar Tree, Jacobs Solutions, Keysight Technologies, Paccar, and Schwab

Dollar Tree

We increased our position in Dollar Tree (DLTR), as its current valuation suggests that no value is being attributed to the Family Dollar (FD) retail concept, and only a modestly successful future is priced in for the Dollar Tree concept. While we are disappointed by the reduced earnings guidance for this fiscal year, store traffic remains strong, holding onto significant market share gains from recent years, with encouraging signs of acceleration in both sales and earnings going forward.

Year-to-date, Dollar Tree has seen consistently positive traffic, with sales and transactions outperforming comparable Nielsen statistics. Sales-per-square-foot productivity, a key performance metric, continues to rise, and new store openings have accelerated as the concept gains traction with higher-income customer segments. Additionally, management is fast-tracking the rollout of an expanded multi-price-point (MPP) strategy, which is expected to positively impact results in late 2024 and into 2025. So far, Dollar Tree has converted 1,600 of its 8,600 stores to the MPP format, and these stores are seeing same-store sales growth of around 5%. By the end of the year, 3,000 stores will have transitioned to the MPP format, with another 3,000 slated for conversion next year.

While the investment costs in the stores have been aggressive, these should level out going forward. Management has guided for materially higher operating margins in the medium term compared to this year, and it is reasonable to expect that earnings will be significantly higher within a few years. For these reasons, we believe there is more intrinsic value in the business than is currently reflected in the stock price, making it a worthwhile long-term holding.

Jacobs Solutions

We increased our position in Jacobs Solutions (J), as the stock appears undervalued relative to its peer group and our intrinsic value estimate. In September, Jacobs separated into two companies: the "Remainco" Jacobs and Amentum, which will encompass Jacobs' Federal Government services business. We believe this separation will further emphasize Remainco’s exposure to attractive end markets, such as water infrastructure, health and life sciences, and advanced manufacturing, all of which are expected to benefit from sustained demand for Jacobs' engineering and consulting services.

By creating two more focused entities, we anticipate that both companies—particularly Remainco Jacobs—will achieve higher valuation multiples compared to the current level. Additionally, backlog growth in the Remainco Jacobs businesses has been strong and is accelerating, providing a solid foundation for growth in 2025. We believe it is prudent to increase our position size ahead of the business split.

Keysight Technologies

Keysight Technologies (KEYS) provides test and measurement equipment and software across a wide range of end markets, including wireless and wireline communications (such as data center components), aerospace and defense, semiconductors, automotive, and various others. For virtually any hardware that sends or receives a signal, Keysight offers testing and quality control solutions in the manufacturing process. As the largest player in the industry, Keysight boasts an internal R&D budget larger than the total revenues of many of its competitors, giving it a significant edge. This strong R&D investment, coupled with its deep integration into customers' workflows, enhances its first-mover advantage in evolving technology trends and solidifies its competitive position.

Over the past year, Keysight's sales have been volatile, primarily due to broad economic weakness in China and inventory reductions, which have led to a slowdown in R&D spending across many of its end markets. This volatility has contributed to weakness in the share price, prompting us to increase our position multiple times over the past year. With many of Keysight’s customers now reporting stronger sales trends, our belief that Keysight remains a vital and entrenched link in the chain of technological advancement, and the share price continuing to remain under pressure, we saw this as an opportune time to further increase our portfolio weight in the company’s shares.

Paccar

We increased PACCAR’s (PCAR) weighting in our portfolio following recent share-price weakness. Recall that we trimmed the position in March of this year after a period of relative share-price outperformance, as we felt that the shares then reflected a high level of optimism, warranting a more modest position size. Since that trim, PACCAR’s shares have declined by 18%, while the S&P 500 has appreciated by 5%. We now see it as prudent to rebalance the share’s back up to a higher weighting.

PACCAR is showing solid market share gains in North and South America, with some softness in new builds in Europe. We believe that PACCAR’s structurally higher profitability, strong market share, and favorable product mix continue to offer opportunities for further share price appreciation over the medium term. The recent price correction has reduced some of the macroeconomic risks associated with the stock, making the investment case more favorable.

Schwab

Schwab has successfully navigated a series of challenges since the Federal Reserve began raising interest rates in 2022. Despite these hurdles, the company has steadily enhanced its platform for both advisors and retail customers, while continuing to accumulate client assets. With client assets now approaching $10 trillion (up from $7 trillion at the end of 2022), a strong capital cushion above regulatory minimums, and the Fed signaling significant cuts to short-term interest rates, Schwab is well-positioned to resume growing its balance sheet, pay down high-cost short-term borrowings, and reinvest bank sweep cash at higher yields.

Though there are many variables at play, the stock has not yet reacted to the Fed’s shift toward an easing cycle, creating a favorable balance between upside potential and downside risk. Given these factors, we have elected to increase our exposure to Schwab.

Excited: General Motors and Spotify Technology

General Motors (GM)

We have exited our long-held position in General Motors (GM). From the outset, we were under no illusions that GM was a high-quality business by our usual standards. The automotive industry is highly competitive, with only modest barriers to entry, and demand for big-ticket, discretionary products like automobiles is subject to the cyclical ups and downs of the broader economy. Nevertheless, CEO Mary Barra and her team had significantly improved the company’s operations since its exit from bankruptcy following the 2008 Global Financial Crisis. GM's renewed focus on trucks and large SUVs—where its Chevy and GMC brands built strong customer loyalty and offered the highest profit margins—along with the elimination of low-volume, low-profit vehicles, the sale of loss-making European operations, a refreshed Buick brand, and restructuring of its international business in South America and Asia, resulted in structurally higher profit margins that proved more resilient to demand swings.

Throughout labor strikes, supply chain disruptions, and other economic shocks, GM remained solidly profitable in every quarter over the past decade, except for Q2 of 2020, when the world was grappling with the onset of COVID-19. However, significant investments required to transition the company toward battery-powered electric vehicles (BEVs) and to fund Cruise, GM’s autonomous vehicle start-up, consumed much of the legacy business’s profit in recent years. We were optimistic that once this investment cycle concluded, BEV production would ramp up, and excess cash flow could be returned to shareholders. By 2023, that outlook started to materialize. After navigating the UAW strike in the fall of 2023, GM announced cost cuts that offset the higher labor costs negotiated with the union and revealed a $10 billion accelerated share repurchase program, with additional capacity beyond that.

Since the start of 2023, GM has reduced its share count by 20%, reinstated its dividend, and exceeded profit expectations. An additional $6 billion share buyback authorization (~12% of GM’s current $51 billion market cap) was approved earlier this year, and since the low in sentiment last November, shares have returned over 70%.

Despite the shares still trading at less than 5x forward earnings (including losses from Cruise), we have decided to exit the position. Initially, we believed GM’s early investments in building a comprehensive EV platform and scaling EV production would provide a competitive edge over peers that took a more piecemeal approach, rushing inferior vehicles to market. However, the recent slowdown in consumer demand for EVs has led us to reevaluate this thesis. While both EV and autonomous vehicle technologies are advancing—and EVs continue to gain market share in the U.S. and globally—the expected payoff from these investments now appears further away than we had anticipated. Additionally, Chinese subsidies for domestic automakers have triggered an arms race that has dimmed the profitability prospects for GM’s once-thriving Chinese joint ventures. After the significant run-up in GM’s share price over the past year, we reassessed the risk vs. reward and found the balance less compelling, prompting our decision to exit the position.

Spotify Technology

Spotify (SPOT) remains the clear leader among global music streaming platforms, benefiting from the growing adoption of streaming and even capturing some market share from less-focused competitors like Apple and Amazon. The company has also executed well, streamlining its cost structure after increased spending during COVID-19 and turning a profit sooner than expected. Spotify now appears on track to exceed the long-term profit margin targets set in 2022. Over the past year, the company’s performance has left little to criticize.

However, with the substantial appreciation of its shares this year, we believe that the expectations for strong user growth, rising prices, and higher margins are already fully reflected in the current share price. This leaves little room for error and offers only modest upside potential from here.

Trimmed: American Express, Analog Devices, Apple, Berkshire Hathaway, Hasbro, JP Morgan, Motorola Solutions, and Philip Morris

American Express

Long-time holding American Express (AXP) has gained almost 90% since last October’s lows. We remain optimistic regarding the strength of the Amex brand, their relatively affluent base of cardholders, and their ability to increase share of total card spend, but opted to repurpose a small amount of capital, where necessary, to move into more discounted holdings and to add some dry powder for future actions.

Analog Devices

This is the second consecutive quarter in which we have trimmed our position in Analog Devices (ADI). Despite a reduction in earnings estimates due to weak end-market demand, the stock has continued to rise on positive sentiment surrounding semiconductor stocks. Specifically, growth prospects for the automotive industry have diminished, and expectations for Analog’s medium-term earnings in 2025 and 2026 have been lowered due to slower macroeconomic conditions. While we are currently navigating a downcycle, investors are focusing on a strong anticipated recovery, pushing the stock to record highs. We believe this presents an opportunity to reallocate capital into stocks with more favorable risk-reward profiles.

Apple

Apple’s (AAPL) closed ecosystem, utilized by over a billion users worldwide and supported by sleek devices and an extensive range of services and subscriptions, is arguably one of the most valuable assets in existence. The strong network effects and brand loyalty Apple enjoys are perfectly illustrated by the reactions when an Android user joins a group chat, turning the message bubbles from blue to green. However, Apple faces several potential headwinds moving forward. The company’s enormous size makes it challenging to sustain significant growth, there are ongoing concerns regarding geopolitical tensions between China and Taiwan, and we are closely monitoring a recent antitrust ruling that could impact the longstanding symbiotic relationship between Alphabet and Apple, where Alphabet pays Apple to be the default search engine on iPhones. With shares trading at approximately 30 times earnings, we believe it is prudent to further reduce our position in Apple in favor of alternatives that offer more attractive valuations relative to their risk.

Berkshire Hathaway

We trimmed our position in Berkshire Hathaway (BRK.A/BRK.B) due to valuation considerations and its substantial weight in the portfolio. For many years, Berkshire traded at a significant discount to a conservatively estimated value of its diverse business interests and securities holdings. Our investment approach has been validated by above-market returns over the past five years, including a 29% return year-to-date, which have helped narrow the gap between the stock’s price and its intrinsic value. As a result, we decided to moderately reduce Berkshire’s weight in the portfolio, where it was one of our largest holdings, and redeploy the capital into other opportunities.

Hasbro

Hasbro (HAS) navigated a challenging 2023 holiday season and undergone a restructuring of its toy business, which led to a decline in shares during Q4 of last year. Year-to-date, however, the transformation of its toy division has made significant strides. Retail inventories are at healthy levels, Magic: The Gathering has demonstrated resilience, even as it laps 2023’s Lord of the Rings tie-in (the best-selling set in the game’s history), and Monopoly Go! has sustained its position as the top free mobile gaming app since its launch in April 2023. As a result, Hasbro’s shares have appreciated this year.

While the shares remain below our original purchases in 2020 and 2021, they have gained 11% since we significantly added to the position in August last year. At current levels, the market appears to have better recognized the progress in transforming the Consumer Products business and the value of Magic: The Gathering and Hasbro’s expansive intellectual property portfolio. Given this, we have chosen to redeploy some capital into other names where we see a more attractive balance of risk and reward.

JP Morgan

Fueled by a return to growth in investment banking and trading revenues, a stabilization in net interest income, and muted expectations for loan losses as fears have eased regarding “the recession that wasn’t,” JPMorgan (JPM) has been one of our strongest performers year-to-date and is currently trading near an all-time high. Despite the bank's consistently strong execution across various business lines and its industry-leading returns on tangible common equity, we believe this is a prudent time to reallocate some capital to other opportunities, given the inherently cyclical nature of the business.

Motorola Solutions

Motorola Solutions (MSI) continues to show excellent execution as they leverage their position as the leader in Land Mobile Radio systems and extend their capabilities in video security and command center software. Government funding and trade policies have been tailwinds, as has a recovery from COVID-era supply chain constraints. The market has come to a greater appreciation for Motorola’s advantageous situation and the shares trade closer to our estimate of fair value.

Philip Morris

Philip Morris (PM) continues to make significant progress toward its goal of sourcing a majority of its revenues from “reduced-risk products,” steering the business further away from its traditional combustible products. This transformation has been supported by the strong performance of Zyn nicotine pouches, which has exceeded our growth expectations since Philip Morris acquired Swedish Match early last year. With shares appreciating 33% over the past four months from what we considered an overly pessimistic base, the position size has naturally increased. Given that our estimate of fair value has not meaningfully changed, we see this as an opportune time to modestly reduce our position, though it will remain one of our largest holdings.

--------------------------------------

[1] The returns for the equity portion of your individual account will differ somewhat from the Composite due to variations in account holdings, cash position, and other client-specific circumstances.

DISCLOSURES

Fees: Gross-of-fees returns incorporate the effects of all realized and unrealized gains and losses and the receipt, though not necessarily the direct reinvestment, of all dividends and income. Gross-of-fees returns are presented before management fees, but after all trading expenses. Prior to October 1, 2020, Composite net-of-fees returns were calculated by deducting model investment management fees, which are defined as the highest, generally applicable fees of 1.25% of equity assets and 0.50% of cash assets, from the gross composite return. Beginning on October 1, 2020, the Composite net-of-fees returns are calculated by deducting model investment management fees, which are defined as the highest, generally applicable fees for the strategy of 1.00% of all composite assets. The firm’s current management fee schedule is as follows: 1.25% on assets below $1 million, 1.0% per annum for assets from $1 million to $5 million, 0.85% per annum on assets from $5 million to $10 million, 0.75% per annum for assets from $10 million to $20 million, 0.65% per annum for assets from $20 million to $35 million, 0.55% per annum for assets from $35 million to $50 million, and 0.50% per annum for assets over $50 million. Such fees are negotiable. Where applicable, the total bundled or wrap fee charged to each portfolio is dependent on the end client’s financial advisor and wrap sponsor. The composite includes accounts that do not pay trading fees.

Prior to January 1, 2010, the Composite included the performance of assets that had been “carved out” of multiple asset class portfolios. When calculating performance, a hypothetical cash balance for each month was allocated to the carve-out on a pro-rata basis relative to the portion of each portfolio’s assets that comprised the carved-out asset class. Beginning January 1, 2010, changes in the GIPS standards caused the Composite to be redefined and all carve-outs to be removed from the Composite. Carve-outs formerly included in the Composite continue to be managed in the same manner as they were before being removed from the Composite.

Definition of The Firm: Kovitz Investment Group Partners, LLC (Kovitz) is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940 that provides investment management services to individual and institutional clients. From October 1, 2003, to December 31, 2015, the Firm was defined as Kovitz Investment Group, LLC. Effective January 1, 2016, Kovitz Investment Group, LLC underwent an organizational change and all persons responsible for portfolio management became employees of Kovitz. From January 1, 1997, to September 30, 2003, all persons responsible for portfolio management comprised the Kovitz Group, an independent division of Rothschild Investment Corp (Rothschild).

Composite Definition: The Kovitz Equity Composite includes all fee-paying, discretionary portfolios managed to the Kovitz Core Equity strategy. The Kovitz Core Equity strategy utilizes a private owner mentality to purchase equity securities issued by companies with durable competitive advantages and strong balance sheets that are trading at a significant discount to their intrinsic value. The goal of this strategy is to maximize long-term total return. The Composite’s inception date is January 1, 1997. The Composite was created on January 1, 2001. Effective January 1, 2000, the Composite no longer included portfolios managed by a manager who made a change in investment style. The persons currently responsible for managing Composite portfolios have been primarily responsible for portfolio management throughout the entire period shown. The minimum portfolio size to be included in the Composite is $250,000 until December 31, 2021. Thereafter, the strategy minimum was raised to $1 million. Portfolios in the Composite may occasionally make use of leverage and/or derivatives, but such use does not have a material effect on Composite performance. The use of derivatives is generally limited to covered call writing, and uncovered option writing is never used.

The benchmark for the Composite is the S&P 500 Index. The S&P 500 Index is composed of 500 leading companies in the United States, covers approximately 75% of the market capitalization of U.S. equities, and serves as a proxy for the total market. The S&P 500 Index returns do not include the effect of transaction costs or fees and assume reinvestment of dividends into the index.

GIPS: Kovitz Investment Group Partners, LLC (Kovitz) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Kovitz has been independently verified for the periods January 1, 1997 through December 31, 2022. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Valuations are computed and performance is reported in U.S. dollars. The measure of internal dispersion presented above is an asset-weighted standard deviation. The three-year standard deviation presented above is calculated using monthly net-of-fees returns. The three-year standard deviation is not presented when returns of less than 36 months are available. The risk measures, unless otherwise noted, are calculated gross of fees. A complete listing of composite descriptions and policies for valuing portfolios, calculating performance, and preparing GIPS reports are available on request. The composite includes accounts that do not pay trading fees.

The description of products, services, and performance results of Kovitz contained herein is not an offering or a solicitation of any kind. Past performance is not an indication of future results. Securities investments are subject to risk and may lose value.