Market Summary

In last quarter’s letter, we speculated that company fundamentals were finally becoming a more significant driver of stock market performance than interest rates. It appears we were mistaken, or at least premature. This quarter, the primary focus of most equity market participants has returned predominantly to the Federal Reserve's next moves concerning interest rates.

Hotter than expected inflationary readings rattled stocks in April and sent bond yields to their highest levels since November of last year. Lingering inflation has been the main issue troubling investors as many came into 2024 betting on as many as a half-dozen rate cuts, only to rapidly scale back those bets when the Consumer Price Index (CPI) repeatedly topped expectations. There was even speculation that, instead of lowering rates, the Federal Reserve might need to increase its benchmark rate to decisively curb inflation. However, this fear was quickly reversed with some cooler inflation prints and economic data releases showing some cracks in what has been a surprisingly resilient economy.

This created a new concern: rate cuts may be forthcoming not because inflation is trending downward, but to prop up a sagging economy. In the often counterintuitive world of investor sentiment, any "bad" economic news had previously been seen as "good" news for the stock market, as a slowing economy would help take the edge off inflation and indicate that the Fed was closer to cutting rates. Now, "bad" economic news is being treated as "bad" news for the market, as a weakening economy could hurt corporate earnings. However, just as this narrative began to take hold, a "blockbuster" May jobs report, with employment and wage gains exceeding expectations, flipped sentiment again by suggesting that the Fed could remain on hold for longer. Thus, "good" economic news has become "bad" news for the market.

Investors seem understandably confused. The Federal Reserve Bank of Atlanta’s GDPNow tracker, a real-time estimate of the current quarter’s GDP, swung from over 4%, to under 2%, to back over 3%, all within a one month period. Investors relying on short-term economic data for buy/sell signals are likely experiencing whiplash right now. Using macroeconomic data to predict market movements is a challenging game and one we largely avoid. It's not that we are unaware or lack opinions on the macroeconomy; we simply do not allow it to influence our investment decisions and risk client capital – or our own – based on fleeting conjecture.

Trying to predict the direction of the stock market, while laudable, has almost always produced the same disastrous result. Mostly, it leads to depriving oneself of owning quality companies and benefitting from their compound growth in earnings and market value out of fear of macroeconomic or political events. To avoid such a fate, we focus almost all our time and attention on individual companies that, in our opinion, possess a combination of qualities that are sustainable and difficult to reproduce. It’s also important these companies have economic models generating returns on capital above their cost of capital, thereby creating value at a rate greater than the mere addition to capital through the retained earnings of the businesses.

Our mission is to be long-term owners of above-average businesses selling at reasonable prices and to remain unfazed by the vicissitudes of the economy, geopolitics, and financial markets. This approach is the best way we’ve found to compound wealth over the long term. Continuing to learn from our mistakes, maintaining a disciplined approach to portfolio construction and risk management, and fostering a collaborative environment among the research team are also essential in this regard.

Performance Summary

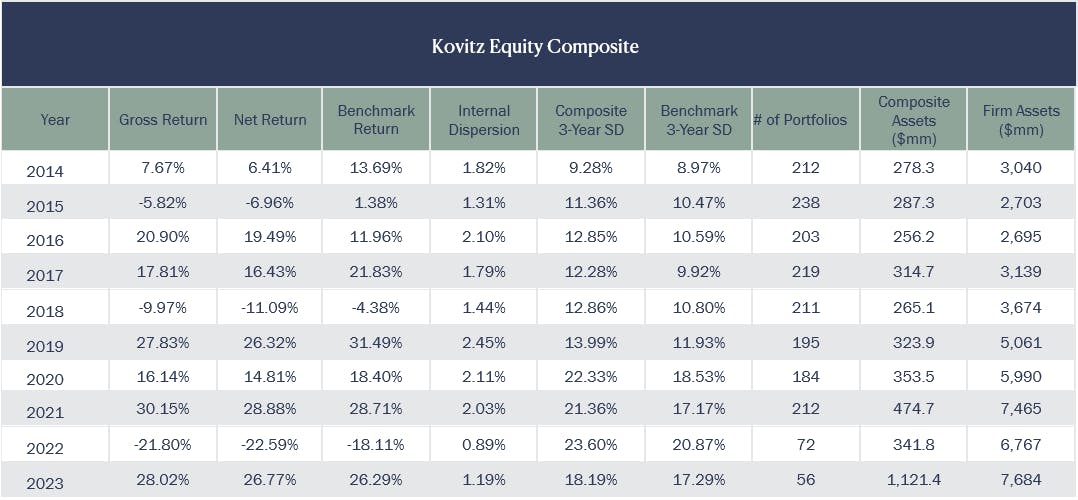

During the second quarter of 2024, the Kovitz Equity Composite[1] (the “Composite”) decreased by 1.2%1, net of fees. By way of comparison, the S&P 500 increased 4.3% while the Russell 1000 Value Index fell 2.2% for the same period. Year-to-date, the Composite is up 9.0%, while the S&P 500 and the Russell 1000 have risen 15.3% and 6.6%, respectively.

--------------------------------------

Over time, there has been a notable change in the degree of concentration in the stock market. A decade ago, it typically took 25-30 companies to contribute a third of the S&P 500's performance. Five years ago, this number decreased to 10-12 companies. Since the Covid-19 pandemic, it has taken just 3-5 companies to achieve the same impact.

This year, the concentration in performance has reached an extreme, with one company, Nvidia, contributing roughly a third of the index’s performance so far this year. Driven by robust financial results and the excitement surrounding Artificial Intelligence (AI), Nvidia's stock has surged 150% year-to-date. While triple-digit gains are not uncommon for individual stocks, Nvidia's substantial market cap increase from $1.2 trillion at the start of the year to over $3 trillion at June 30 has amplified its influence in the index, single-handedly contributing approximately 5% of the S&P 500’s return year-to-date.

In a typical year, not holding a single stock – no matter how large its return – would not significantly impact our performance relative to a broad index such as the S&P 500, but Nvidia's contribution on its own has largely accounted for most of our lagging year-to-date performance. This environment poses a challenge for those, like us, who strive to build balanced and diversified portfolios. However, there is a potential upside to Nvidia's dominance: many high-quality businesses are currently undervalued, trading at significant discounts to their intrinsic value. Although we do not believe the current AI fervor mirrors the mania of the late 1990s dot-com bubble, it does resemble that era in terms of the preoccupation with certain stocks leaving many great businesses overlooked. As the internet stock boom eventually subsided, it set the stage for strong performance in the following years as investors rediscovered these neglected companies. We believe a similar opportunity exists today.

--------------------------------------

The table below summarizes the annualized and cumulative performance for the Composite, as well as results for the S&P 500 and other benchmarks, over standardized time periods from January 1, 1997, to June 30, 2024.

Since inception on January 1, 1997, the Composite has returned a net annualized rate of 10.5%, compared to 9.5% for the S&P 500 and 8.4% for Russell 1000 Value. Through the power of compounding, the Composite’s annual return translates into a cumulative total return of 1447.8% versus 1122.6% for the S&P 500 over the same time period. The respective cumulative return for the Russell 1000 Value Index has been 823.9%. In dollar terms, $10,000 invested in the Composite, the S&P 500 and the Russell 1000 Value at inception, would be worth $154,776, $122,263, and $92,389, respectively.

These numbers highlight two primary observations:

1. The compounding nature of annual returns is a powerful force.

2. Even seemingly small differences in annualized returns can have an outsized impact when measured over long time periods.

While it may be tempting to try to time the market by jumping in and out at seemingly opportune times, this approach is likely to yield returns far below those achieved through patience and by resisting the urge to “interrupt” the remarkable power of compounding.

Annualized and Cumulative Equity Performance

Source: Bloomberg Finance, L.P.

Fundamentals vs. Expectations

How Horse Racing can Inform Investment Decisions

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” - Phil Fisher

Consider a horse race with two evenly matched horses and 1000 bettors each buying a $2 betting ticket, making the total pot $2000. Because the horses’ past track records are so similar, an equal number of bettors place their bet on both Horse A and Horse B (500 bettors each). Assuming Horse B wins the race, those 500 winners will pocket the pot of $2000, or $4 per person. Each winner will have doubled their $2 bet.

Now imagine a race where Horse A is considered to be much faster and ridden by a better jockey than Horse B. Horse A is such an all-out favorite that all 1000 bettors place their $2 on her. Assuming Horse A does in fact win, the 1000 bettors will share the total $2000 pot; meaning all they get back is their $2 bet, resulting in no profit by betting on the overwhelming favorite. They make no profit because the odds were already priced in. Worse, if Horse A were to stumble or perform below expectations, all bettors would lose their money.

Success in gambling doesn’t just go to those who pick winners, but to those with the ability to identify superior risk/reward propositions. The goal is to find situations where the odds are favorable, whether for the favorite or underdog.

While we don’t mean to imply that stock picking is akin to gambling on horses, similar reasoning holds true for the stock market. When a majority of investors agree on a company’s attractiveness, its valuation increases, reducing the potential gain from the company’s continued operational success. Similar to the favorite in the second horse race, any future success is likely already priced into the shares. You might be correct that it is a wonderful company that turns out consistently high profits, but you might not make any money as its valuation had already accounted for future profit growth. It also heightens the potential loss if the company delivers less-than-stellar results and disappoints investors’ lofty expectations. Just like in horse racing, if an investor believes they know the winner, but everybody else does too, it doesn't necessarily translate into profits.

Successful investing requires explicitly distinguishing between fundamentals and expectations, which are two very different concepts. In horse racing terms, fundamentals would be the horse's prior track record, performance on certain track conditions, and the jockey, while expectations would be the odds placed on each horse to win. As shown above, if expectations are excessively high, great fundamentals can be irrelevant in terms of actually making money. Therefore, it may not prove financially rewarding to buy great, fundamentally strong businesses regardless of price. It may prove worthwhile, however, to purchase great companies at prices that don’t incorporate such high expectations. It’s not just a matter of what you buy, but what you pay for it. That is to say, we are looking for a mispricing of the fundamentals relative to the expectations of other market participants.

Meta Platforms (formerly Facebook) is a recent example where the gap between market expectations and business fundamentals widened dramatically. In late 2021, the company signaled its interest in investing in the metaverse. Besides changing its name, Meta boosted its annual capital expenditure budget by roughly 80%. This came at a time when its principal business, advertising, was slowing dramatically after a spike during the Covid pandemic. Investors reacted negatively, and the stock fell 64% in 2022.

Revisiting our investment thesis, we concluded that the Family of Apps business (Facebook, Instagram and WhatsApp) remained very well positioned and that there were plenty of incentives and opportunities for the management team to optimize the cost structure. Most importantly, the expectations embedded in the stock were that current earnings, which we believed had troughed, were unlikely to grow, leaving the stock trading at under 10x forward earnings. Believing that the core ad business was still solid, we felt that you didn’t need much to go right at that price to earn a good return.

In 2023, facing backlash for its profligate spending, management quickly reversed course, named 2023 its “year of efficiency”, and reduced the company’s head count by 22% while dramatically slowing its spending on the metaverse. Advertising revenue bounced back, growing 16% in 2023, and picked up momentum as the year went on. The operating margin in the company’s core family of apps segment jumped 10 percentage points to 47% in 2023, reflecting the lower operating costs and improved financial performance of products such as Reels, its response to TikTok’s successful short form video concept. This all led to its stock price nearly tripling in 2023.

As long-term investors, we seek to exploit the difference between expectations and fundamentals and buy the stocks of high-quality companies that trade at prices below our estimate of their business values. Understanding this relationship between fundamentals and expectations is crucial in identifying superior investment opportunities and achieving long-term success.

Portfolio Activity

During the quarter, single stock volatility allowed us to actively modify our portfolio. We trimmed two positions in stocks that approached our estimates of fair value and selectively increased our holdings in five positions we believed were trading at significant discounts to our base case valuations. We did not initiate any new positions or completely exit any existing ones.

Increased: Becton Dickinson, DIAGEO, Intercontinental Exchange, Carmax, and PPG

Becton Dickinson

Becton Dickinson's (BDX) recent performance has been positive, with increasing sales momentum in key product categories, including the Alaris Pump. Previously, a regulatory issue with the Alaris Pump affected Becton's revenue growth and stock price starting in 2020. However, the product's return is now contributing to accelerating revenues in 2024 and 2025. The company maintains a strong market share in hospital pumps of around 70%. Becton's advantage lies in its integrated software ecosystem, which includes its pumps, pharmacy dispensing equipment (Pyxis), and HealthSight software, all of which connect seamlessly with existing electronic medical record systems. This comprehensive digital ecosystem has helped BD retain its market share in pumps and now supports its resumed growth.

In addition to increasing revenue and earnings, Becton has a strong balance sheet and a promising new-product development pipeline. The stock has not yet appreciated toward our intrinsic value estimate, and we continue to believe the current price presents a good opportunity for meaningful upside.

Diageo

We are continuing to build our position in Diageo’s (DEO) stock. Despite negative volume growth in spirits sales early in 2024, as retailers and distributors reduce their inventories and demand remains soft, we believe the stock’s valuation more than compensates for this temporary weakness. Our long-term investment thesis remains unchanged: spirits are capturing a larger share of the total alcoholic beverage market, premium brands are outpacing standard brands in growth, the business is resilient to economic cycles, and Diageo is a leader in two of the fastest-growing categories—Scotch and tequila.

During this period of industry softness, Diageo’s management is investing in their brands to achieve long-term market share goals. We expect relief from supply chain costs to positively impact profit margins throughout 2024, offsetting these investments. Additionally, early industry distribution data in the U.S. indicates that some of Diageo’s key brands are gaining traction ahead of industry averages.

Consumer staples stocks have experienced weak performance over the past twelve months, and Diageo is no exception. However, the stock currently trades at an attractive price-to-earnings ratio, which we believe provides a solid foundation for shareholder returns.

Intercontinental Exchange

While Intercontinental Exchange (ICE) is widely known as the owner of the New York Stock Exchange, this represents only a small portion of its diversified operations. ICE also runs leading global futures exchanges and clearinghouses, a fixed income data and analytics business that includes the top global provider of daily pricing for fixed income securities and holds the second position in fixed income indices, and a mortgage technology division that offers origination and servicing software to banks and other lenders. Although primarily recognized as a trading firm, approximately half of ICE's revenues are recurring or subscription-based, providing a stable foundation that balances the transaction-based revenues.

ICE’s mortgage division underwent significant transformation last year with the acquisition of Black Knight (BKI) and its mortgage servicing software platform. This merger created an end-to-end platform covering the entire mortgage lifecycle, including tools for customer acquisition, origination, recording, and servicing. This integrated platform enhances ICE’s value proposition by offering a digital solution to an industry historically burdened by inefficient, paper-based workflows that add unnecessary time and expense to the mortgage origination and servicing processes.

Despite industry-wide mortgage volumes being at generational lows since the dramatic rise in mortgage rates starting in 2022, ICE has continued to attract new customers as lenders aim to improve operational efficiency and consolidate service providers onto a single platform. This positions ICE well for a potential normalization in mortgage volumes, even if the timing of such a rebound remains uncertain.

Recently, ICE’s shares declined following reduced expectations for the Federal Reserve to cut rates this year, leading to lowered projections for 2024 mortgage volumes. This downturn provided an opportunity to increase our position in a business that is expanding its competitive moat across multiple business lines, despite the market's short-term focus on one segment’s near-term results.

CarMax

CarMax (KMX) has been navigating a soft environment for used vehicle sales since early 2022, which was primarily driven by poor affordability after used vehicle prices rose much faster than broader inflation. However, used vehicle prices have now fallen roughly 25% since their early-2022 peak and the relative spread between new and used vehicle pricing is starting to approach historical levels.

While this has been a challenging time for the company, we have been heartened by the management’s efforts to control costs while continuing to enhance their advantages in customer acquisition, vehicle sourcing, and logistics. Since a vehicle is a wasting asset and turnover has been depressed for a couple years now, we believe it is only a matter of time before activity in the overall used vehicle market normalizes. It could be a year or two, but CarMax is primed to capture at least their fair share of the market when that occurs. Despite the uncertainty with regard to timing, we believe current prices reflect a singular focus on current results and offer an opportunity to increase our position in a competitively advantaged business at an attractive discount to our estimate of intrinsic value.

PPG Industries

PPG Industries (PPG) is a leading global coatings company, ranking among the top three in the industry alongside Sherwin Williams and Akzo Nobel. Following a post-COVID revenue recovery driven by price increases, industry revenue growth is slowing to low single digits this year due to moderating prices and sluggish industrial and housing markets. However, PPG has been gaining market share and benefits from unique end market exposures that should support improving volume growth throughout the year. Additionally, PPG's management is strategically divesting underperforming businesses, which is enhancing profitability. Given our long-term revenue and earnings forecast and PPG’s strong balance sheet, we believe the stock is undervalued at its current price.

Trimmed: Analog Devices and Motorola Solutions

Analog Devices

We’ve held Analog Devices in the Core Equity Portfolio since early April 2022, during which time the stock has outperformed the S&P 500 due to high demand for semiconductors. Analog semiconductors, a niche within the broader semiconductor industry, translate physical world properties (e.g., light, sound, vibration, temperature) into digital signals, primarily for industrial and communications applications. The industry reached peak sales in 2023, benefiting from pricing power amidst supply shortages. However, this past year has seen a steep customer inventory correction and soft end-market demand, leading to a typical semiconductor downcycle.

While we are currently in the midst of this downcycle, investors are anticipating a strong recovery, driving the stock to record highs. Our expectations are more modest than the market’s at this point, so we are taking advantage of the appreciation in the stock price to reduce our position size. Despite this adjustment, we believe that Analog Devices remains an excellent long-term investment, capable of compounding earnings through market cycles.

Motorola Solutions

Motorola Solutions (MSI) continues to demonstrate excellent execution, leveraging its leadership in Land Mobile Radio systems while expanding its capabilities in video security and command center software. The company has benefited from favorable government funding and trade policies, as well as a recovery from COVID-era supply chain constraints. The market has increasingly recognized Motorola’s strong position, resulting in the shares trading closer to our fair value estimate. Consequently, as in 2023, we are rebalancing our portfolio by reducing our MSI position in favor of other investments with stronger risk-return profiles.

--------------------------------------

[1] The returns for the equity portion of your individual account will differ somewhat from the Composite due to variations in account holdings, cash position, and other client-specific circumstances.

DISCLOSURES

Fees: Gross-of-fees returns incorporate the effects of all realized and unrealized gains and losses and the receipt, though not necessarily the direct reinvestment, of all dividends and income. Gross-of-fees returns are presented before management fees, but after all trading expenses. Prior to October 1, 2020, Composite net-of-fees returns were calculated by deducting model investment management fees, which are defined as the highest, generally applicable fees of 1.25% of equity assets and 0.50% of cash assets, from the gross composite return. Beginning on October 1, 2020, the Composite net-of-fees returns are calculated by deducting model investment management fees, which are defined as the highest, generally applicable fees for the strategy of 1.00% of all composite assets. The firm’s current management fee schedule is as follows: 1.25% on assets below $1 million, 1.0% per annum for assets from $1 million to $5 million, 0.85% per annum on assets from $5 million to $10 million, 0.75% per annum for assets from $10 million to $20 million, 0.65% per annum for assets from $20 million to $35 million, 0.55% per annum for assets from $35 million to $50 million, and 0.50% per annum for assets over $50 million. Such fees are negotiable. Where applicable, the total bundled or wrap fee charged to each portfolio is dependent on the end client’s financial advisor and wrap sponsor. The composite includes accounts that do not pay trading fees.

Prior to January 1, 2010, the Composite included the performance of assets that had been “carved out” of multiple asset class portfolios. When calculating performance, a hypothetical cash balance for each month was allocated to the carve-out on a pro-rata basis relative to the portion of each portfolio’s assets that comprised the carved-out asset class. Beginning January 1, 2010, changes in the GIPS standards caused the Composite to be redefined and all carve-outs to be removed from the Composite. Carve-outs formerly included in the Composite continue to be managed in the same manner as they were before being removed from the Composite.

Definition of The Firm: Kovitz Investment Group Partners, LLC (Kovitz) is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940 that provides investment management services to individual and institutional clients. From October 1, 2003, to December 31, 2015, the Firm was defined as Kovitz Investment Group, LLC. Effective January 1, 2016, Kovitz Investment Group, LLC underwent an organizational change and all persons responsible for portfolio management became employees of Kovitz. From January 1, 1997, to September 30, 2003, all persons responsible for portfolio management comprised the Kovitz Group, an independent division of Rothschild Investment Corp (Rothschild).

Composite Definition: The Kovitz Equity Composite includes all fee-paying, discretionary portfolios managed to the Kovitz Core Equity strategy. The Kovitz Core Equity strategy utilizes a private owner mentality to purchase equity securities issued by companies with durable competitive advantages and strong balance sheets that are trading at a significant discount to their intrinsic value. The goal of this strategy is to maximize long-term total return. The Composite’s inception date is January 1, 1997. The Composite was created on January 1, 2001. Effective January 1, 2000, the Composite no longer included portfolios managed by a manager who made a change in investment style. The persons currently responsible for managing Composite portfolios have been primarily responsible for portfolio management throughout the entire period shown. The minimum portfolio size to be included in the Composite is $250,000 until December 31, 2021. Thereafter, the strategy minimum was raised to $1 million. Portfolios in the Composite may occasionally make use of leverage and/or derivatives, but such use does not have a material effect on Composite performance. The use of derivatives is generally limited to covered call writing, and uncovered option writing is never used.

The benchmark for the Composite is the S&P 500 Index. The S&P 500 Index is composed of 500 leading companies in the United States, covers approximately 75% of the market capitalization of U.S. equities, and serves as a proxy for the total market. The S&P 500 Index returns do not include the effect of transaction costs or fees and assume reinvestment of dividends into the index.

GIPS: Kovitz Investment Group Partners, LLC (Kovitz) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Kovitz has been independently verified for the periods January 1, 1997 through December 31, 2022. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Valuations are computed and performance is reported in U.S. dollars. The measure of internal dispersion presented above is an asset-weighted standard deviation. The three-year standard deviation presented above is calculated using monthly net-of-fees returns. The three-year standard deviation is not presented when returns of less than 36 months are available. The risk measures, unless otherwise noted, are calculated gross of fees. A complete listing of composite descriptions and policies for valuing portfolios, calculating performance, and preparing GIPS reports are available on request. The composite includes accounts that do not pay trading fees.

The description of products, services, and performance results of Kovitz contained herein is not an offering or a solicitation of any kind. Past performance is not an indication of future results. Securities investments are subject to risk and may lose value.